Financial advice often feels like one-size-fits-all recommendations that ignore a fundamental truth: people are different. What works brilliantly for your detail-oriented friend might feel suffocating to your spontaneous sibling. The budgeting system your colleague swears by might trigger anxiety in you. This disconnect between generic financial guidance and individual temperament explains why so many people struggle to maintain healthy money habits despite understanding their importance.

The breakthrough in personal finance comes from recognizing that your money strategy must align with your personality, not fight against it. Trying to force yourself into a financial system incompatible with your natural tendencies creates unnecessary friction, leading to abandoned budgets, broken saving goals, and persistent financial stress. The most effective money strategy isn’t necessarily the most sophisticated one—it’s the approach you’ll actually follow consistently over years and decades.

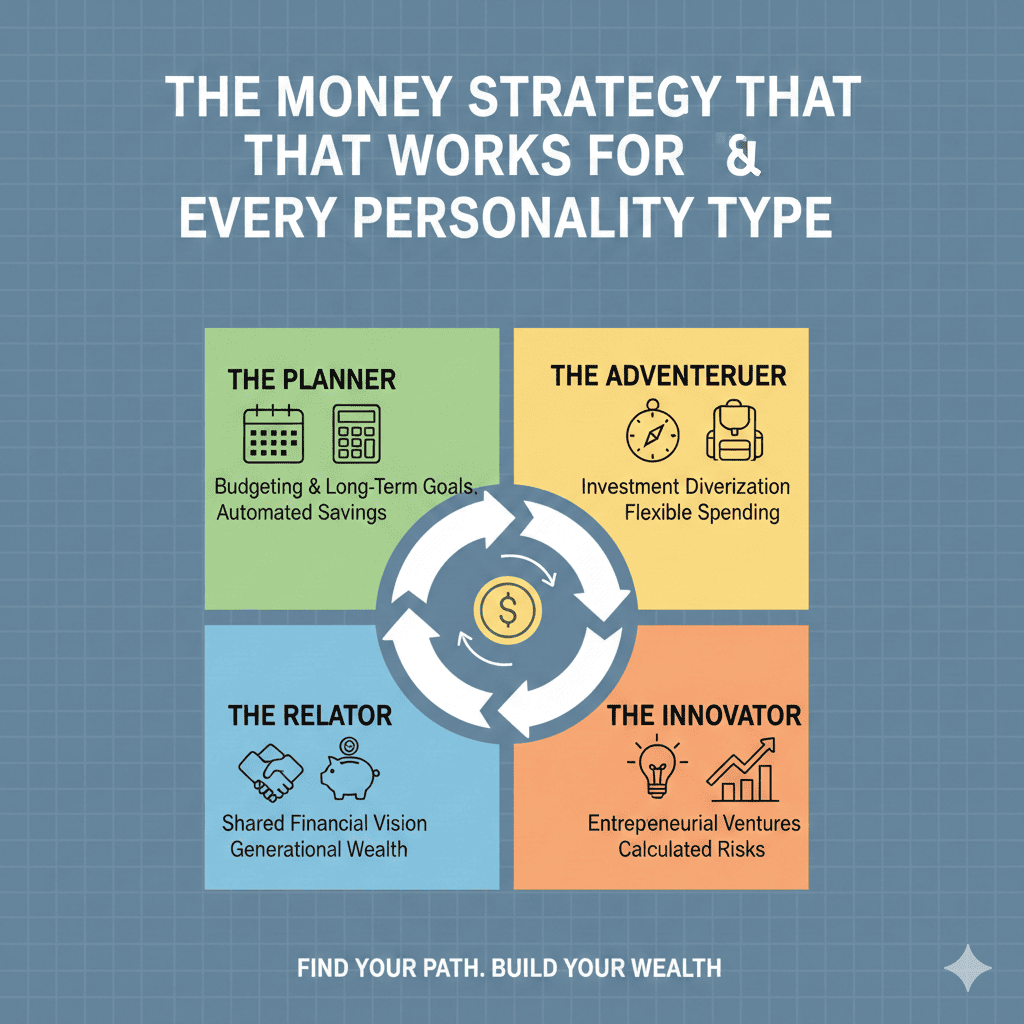

This comprehensive guide helps you identify your financial personality type and provides tailored strategies that work with your natural inclinations rather than against them. You’ll discover why certain financial approaches feel impossible while others flow effortlessly, and you’ll learn to design a money strategy that transforms money management from a dreaded chore into a sustainable system supporting your life goals. Financial success becomes inevitable when your methods match your temperament.

1. The Analytical Planner Personality

Analytical planners thrive on data, detailed tracking, and comprehensive systems that provide complete financial visibility and control.

Identifying Analytical Planner Traits

You enjoy spreadsheets, charts, and numerical analysis. Details energize rather than overwhelm you. You prefer having complete information before making financial decisions. Planning and forecasting feel satisfying rather than constraining. You naturally think in systems and processes. Precision in tracking expenses feels important and worthwhile.

Your Ideal Money Strategy Framework

Zero-based budgeting where every dollar receives a specific assignment satisfies your need for complete control. Track expenses across multiple categories providing granular insight into spending patterns. Use spreadsheets or sophisticated apps like YNAB offering detailed reporting and forecasting capabilities. Maintain separate accounts for different financial goals creating clear organizational structure. Review finances weekly or bi-weekly to stay deeply connected with your money.

Investment Approach for Analytical Types

- Research investments thoroughly before committing funds

- Build diversified portfolios based on calculated risk tolerance

- Track portfolio performance across multiple metrics

- Rebalance systematically according to predetermined schedules

- Consider factor-based investing or strategic asset allocation

- Enjoy the process of optimizing tax efficiency and expense ratios

Savings Systems That Work

Create multiple savings accounts for distinct goals with specific target amounts and timelines. Calculate exact monthly contributions required to reach each goal. Use automated transfers on predetermined dates removing decision-making from the process. Track progress toward goals with visual charts showing advancement. Adjust savings rates based on mathematical optimization of competing priorities.

Potential Pitfalls to Avoid

Analysis paralysis can prevent taking action while seeking perfect information. Over-optimization wastes time on minimal marginal gains. Excessive tracking becomes busywork without adding value. Rigidity prevents adapting to changing life circumstances. Remember that good enough executed consistently beats perfect never implemented.

2. The Freedom-Seeking Adventurer

Freedom seekers prioritize experiences and flexibility, resisting systems that feel confining or limiting to their spontaneous nature.

Recognizing Freedom Seeker Characteristics

You value experiences over possessions and flexibility over routine. Detailed tracking feels restrictive and draining. You prefer big-picture understanding rather than granular details. Spontaneity and adventure rank high in your priorities. Traditional budgets feel like cages limiting your freedom. You trust your intuition about spending decisions.

Your Optimized Money Strategy

Implement the anti-budget approach focusing on automating savings first rather than restricting spending. Set up automatic transfers moving predetermined percentages into savings and investment accounts immediately when income arrives. Whatever remains becomes guilt-free spending money requiring no tracking. Use a reverse budget where you define savings goals and essential expenses, then spend the remainder freely.

The Bucket System for Freedom Lovers

- Create three primary accounts: Bills, Goals, and Fun

- Automatically split income between buckets at predetermined percentages

- Pay fixed expenses from Bills account without thinking

- Save for goals automatically through Goals account

- Spend Fun account freely without guilt or tracking

- Adjust bucket percentages quarterly rather than micromanaging daily

Investment Strategy for Adventurers

Choose simple, hands-off investment approaches requiring minimal ongoing attention. Target-date funds automatically adjust asset allocation as you age. Robo-advisors handle portfolio management without your involvement. Dollar-cost averaging through automatic investments removes timing decisions. Focus on setting good initial parameters then letting systems run independently.

Avoiding Common Freedom Seeker Traps

Ensure automated savings occur before money reaches spending accounts. Build adequate emergency funds preventing financial emergencies from derailing adventures. Consider travel rewards credit cards aligning spending with experience values. Set annual or quarterly financial reviews rather than constant monitoring. Accept that imperfect systems consistently followed outperform perfect systems abandoned.

3. The Security-Focused Guardian

Guardians prioritize safety, stability, and preparedness, finding comfort in robust financial buffers and conservative approaches.

Identifying Guardian Personality Traits

Financial security feels more important than aggressive growth. Losing money causes significant anxiety and stress. You prefer guaranteed returns over volatile higher-potential investments. Emergency funds and insurance provide psychological comfort. Risk-taking with money feels uncomfortable regardless of potential rewards. You naturally plan for worst-case scenarios.

Your Protective Money Strategy

Build substantial emergency funds covering twelve months of expenses rather than the typical three to six months. Prioritize debt elimination creating freedom from payment obligations. Focus on guaranteed returns through high-yield savings accounts, CDs, and bonds. Maintain comprehensive insurance coverage across health, life, disability, and property. Create detailed financial plans addressing various negative scenarios.

Conservative Investment Approach

- Emphasize principal protection over maximum returns

- Allocate larger portfolio percentages to bonds and stable value funds

- Use laddered CDs providing guaranteed returns and liquidity

- Consider annuities offering guaranteed income streams

- Gradually increase stock exposure only as comfort develops

- Focus on dividend-paying blue-chip stocks for equity exposure

Budgeting Methods for Guardians

Envelope budgeting creates physical or digital envelopes for spending categories with fixed amounts. Once an envelope empties, spending in that category stops until the next period. This concrete system prevents overspending and provides visible security. Track actual spending against budgeted amounts to identify risks early. Build sinking funds for irregular expenses preventing surprises.

Managing Guardian Tendencies

Balance security needs with inflation protection through modest equity exposure. Recognize that excessive cash holdings lose purchasing power over time. Challenge yourself to take small calculated risks building confidence gradually. Ensure focus on security doesn’t prevent enjoying life today. Consider working with fee-only financial advisors providing objective guidance and reassurance.

4. The Status-Conscious Achiever

Achievers connect money with success metrics, motivated by reaching financial milestones and comparing favorably to peers and benchmarks.

Recognizing Achiever Characteristics

Financial goals motivate you more than budgets constrain you. You enjoy tracking net worth growth and hitting targets. Competition and comparison drive your financial behaviors. Visible success markers feel important and motivating. You research financial benchmarks for your age and income. Gamification and challenges enhance your engagement with money management.

Your Achievement-Oriented Money Strategy

Set specific, measurable financial goals with clear deadlines creating concrete targets. Track net worth monthly watching progress toward milestones. Use financial apps with achievement badges and progress visualizations. Create challenges like no-spend months or savings sprints. Compare your progress against age-based benchmarks and millionaire-next-door metrics. Celebrate milestone achievements reinforcing positive behaviors.

Goal-Based Investing Approach

- Assign specific purposes to investment accounts

- Set target amounts and timelines for each goal

- Track progress toward individual goals separately

- Compete against your own past performance

- Use target-date or goal-based investment platforms

- Consider impact investing aligning money with values

The Milestone Money Strategy

Define clear financial milestones such as first ten thousand in savings, debt freedom, six-figure net worth, or specific investment balances. Break large goals into smaller sub-goals providing frequent wins. Create visual progress trackers displaying advancement toward targets. Share goals with accountability partners or online communities. Reward yourself appropriately when achieving significant milestones.

Avoiding Achiever Pitfalls

Resist keeping up with the Joneses through unnecessary consumption. Distinguish between healthy goal-setting and unhealthy comparison creating dissatisfaction. Balance aggressive saving with quality of life today. Recognize that social media often presents distorted financial realities. Measure success by your own values rather than external validation. Focus on sustainable pace preventing burnout.

5. The Relationship-Oriented Connector

Connectors view money primarily through the lens of relationships, prioritizing generosity, shared experiences, and supporting loved ones.

Identifying Connector Personality Traits

You find joy in using money to strengthen relationships and help others. Shared experiences with family and friends justify spending. Generosity feels more satisfying than personal accumulation. Financial decisions consider impact on relationships. You struggle saying no to requests from loved ones. Budgeting feels selfish when it limits giving or shared activities.

Your Relationship-Centered Money Strategy

Build generosity and relationship spending into your budget as priorities rather than afterthoughts. Create specific categories for gifts, shared experiences, and helping others with defined amounts. This legitimizes relationship spending while preventing it from derailing other financial goals. Automate charitable giving ensuring consistency. Communicate financial boundaries with loved ones maintaining both relationships and financial health.

Balancing Generosity and Stability

- Define a sustainable generosity percentage of income

- Create a dedicated giving fund separate from emergency savings

- Practice thoughtful giving focusing on meaningful impact

- Develop scripts for declining requests without damaging relationships

- Involve family in financial decisions creating shared ownership

- Build relationship experiences into financial planning

Family-Oriented Financial Planning

Prioritize college savings and inheritance planning for children. Include spouse or partner in all significant financial decisions. Create family financial meetings discussing goals and values. Teach children about money through age-appropriate involvement. Plan and budget for quality time and shared experiences. Consider how financial decisions affect family dynamics and relationships.

Managing Connector Challenges

Establish clear boundaries preventing financial enabling of unhealthy behaviors. Recognize that financial stability enables greater long-term generosity. Avoid sacrificing retirement security to fund adult children’s lifestyles. Discuss money openly with partners preventing resentment and misunderstanding. Remember that saying yes to every request means saying no to your own financial security.

6. The Creative Visionary

Visionaries think in big-picture concepts and future possibilities, struggling with detailed tracking but excelling at innovative financial thinking.

Recognizing Visionary Traits

You focus on future possibilities and long-term vision rather than current details. Creative solutions to financial challenges excite you. Traditional budgeting feels tedious and uninspiring. You see money as a tool for creating desired future rather than numbers to track. Ideas and concepts motivate you more than spreadsheets. You prefer conceptual frameworks over detailed systems.

Your Vision-Based Money Strategy

Start with your ideal future life and work backward to required financial steps. Create a vivid vision board depicting financial goals and desired lifestyle. Use values-based budgeting allocating money to categories aligned with priorities. Implement simple automation handling details without requiring constant attention. Focus on a few key metrics rather than comprehensive tracking. Review finances monthly using big-picture perspective rather than daily details.

Simplified Investment Approach

- Choose set-it-and-forget-it investment strategies

- Use three-fund portfolios minimizing complexity

- Automate contributions removing ongoing decisions

- Review portfolio quarterly rather than constantly

- Focus on allocation strategy rather than individual holdings

- Consider working with advisors handling implementation details

The Values-Aligned Financial System

Identify your core values and life priorities. Allocate your budget according to values rather than arbitrary percentages. Ensure spending aligns with what matters most to you. Eliminate expenses contradicting your values freeing money for priorities. Create financial goals supporting your vision rather than following conventional wisdom. Make financial decisions by asking whether they serve your bigger picture.

Overcoming Visionary Obstacles

Partner with detail-oriented friends or professionals handling implementation. Set simple systems requiring minimal maintenance and attention. Use visual tools and charts making financial information more engaging. Focus on a few powerful strategies rather than optimizing everything. Schedule periodic deep dives into finances while maintaining simplicity daily. Accept that good enough consistently applied beats perfect rarely executed.

7. The Spontaneous Optimizer

Optimizers seek efficiency and value, motivated by getting the most from every dollar while maintaining flexibility in execution.

Identifying Optimizer Characteristics

You enjoy finding deals, maximizing value, and eliminating waste. Spending efficiently feels rewarding regardless of amount. You research purchases seeking optimal value for money. Systems and hacks for financial efficiency appeal to you. Credit card rewards, tax optimization, and money-saving strategies engage your interest. You dislike waste more than you love luxury.

Your Efficiency-Focused Money Strategy

Track spending to identify optimization opportunities without obsessing over every dollar. Use credit card rewards strategically maximizing cash back or travel points. Shop intentionally comparing options before purchases. Build skills reducing recurring expenses like cooking, basic repairs, or negotiating. Focus optimization energy on big recurring expenses with compounding impact. Automate optimized systems once established removing ongoing effort.

Strategic Spending Optimization

- Negotiate recurring bills annually including insurance, internet, and phone

- Use comparison tools for major purchases ensuring best value

- Buy quality items lasting longer rather than cheap replacements

- Implement the twenty-four-hour rule preventing impulse purchases

- Calculate cost-per-use for purchases justifying higher upfront costs

- Focus optimization on housing, transportation, and food having largest impact

Investment Optimization Strategies

Minimize investment fees through low-cost index funds and ETFs. Maximize tax-advantaged account contributions. Implement tax-loss harvesting reducing tax burden. Use asset location strategy optimizing account types for holdings. Consider mega backdoor Roth conversions when applicable. Optimize withdrawal strategies in retirement minimizing lifetime taxes.

Avoiding Optimizer Traps

Recognize when optimization time exceeds value gained. Don’t sacrifice quality of life for minimal savings. Avoid false economy where cheap purchases cost more long-term. Balance optimization with earning more rather than only cutting expenses. Ensure optimization serves larger goals rather than becoming the goal itself. Remember relationships and experiences provide value beyond dollar amounts.

8. Creating Your Personalized Hybrid Strategy

Most people exhibit characteristics from multiple personality types requiring customized approaches combining strategies.

Identifying Your Financial Personality Mix

Review descriptions for each personality type noting which characteristics resonate strongly. Most people strongly identify with one or two primary types. Secondary characteristics from other types influence preferences and behaviors. Your financial personality may differ from your general personality. Past financial experiences and family money messages shape your current approach.

Building Your Custom Money Strategy

Start with the primary framework matching your dominant financial personality. Incorporate specific tactics from secondary personality types addressing your situation. Test different approaches for several months before committing fully. Adjust systems when they create friction rather than forcing incompatible methods. Recognize that your optimal money strategy evolves as life circumstances change.

Combining Complementary Approaches

- Analytical planners can adopt freedom seeker automation reducing tracking burden

- Freedom seekers benefit from guardian emergency funds providing security for spontaneity

- Guardians can embrace achiever goal-setting creating purpose beyond just safety

- Achievers need connector awareness preventing relationship damage from competitive behaviors

- Connectors require optimizer strategies ensuring generosity remains sustainable

- Visionaries benefit from analytical systems handling details they naturally avoid

Adapting Your Strategy Over Time

Life stages influence which money strategy elements take priority at different times. Early career demands different approaches than mid-career or retirement. Family situations alter which personality traits dominate financial decisions. Economic environments may require temporary adjustments to your usual approach. Major life transitions warrant reviewing and potentially revising your financial personality alignment.

Working With Different Money Personalities

Partners often have different financial personalities creating conflict without mutual understanding. Discuss personality types openly identifying each person’s natural tendencies. Divide financial responsibilities according to strengths and preferences. Establish shared goals and values transcending personality differences. Create systems accommodating both personalities rather than forcing one approach. Schedule regular money dates discussing finances when emotions are calm.

9. Implementing Your Personality-Aligned Money Strategy

Understanding your financial personality means nothing without implementation translating insight into action and results.

Starting Your Personalized System

Choose three to five key strategies from your personality profile to implement first. Avoid overwhelming yourself trying to perfect everything simultaneously. Focus on high-impact changes affecting the largest portions of your finances. Give new systems at least ninety days before judging effectiveness. Track what works and what creates friction requiring adjustment.

Building Sustainable Financial Habits

Align new habits with existing routines rather than creating entirely new behaviors. Start with embarrassingly small actions building momentum before increasing difficulty. Use implementation intentions specifying when and where financial tasks occur. Create environmental cues triggering desired financial behaviors automatically. Celebrate small wins reinforcing positive associations with money management.

Tools and Resources by Personality

Analytical planners excel with YNAB, spreadsheets, and Personal Capital providing detailed data. Freedom seekers prefer Qapital, Digit, or simple checking account splits requiring minimal interaction. Guardians benefit from high-yield savings accounts, insurance comparison tools, and conservative allocation funds. Achievers thrive with Mint, net worth trackers, and goal-based investment platforms. Connectors need simple systems plus charitable giving platforms and family financial planning tools. Visionaries prefer robo-advisors, automated investing, and big-picture dashboards. Optimizers enjoy credit card rewards programs, comparison shopping tools, and fee analyzers.

Measuring Success Appropriately

Define success metrics matching your personality rather than arbitrary standards. Analytical types measure detailed category adherence and optimization metrics. Freedom seekers track whether automated savings happen consistently regardless of spending patterns. Guardians monitor emergency fund growth and risk mitigation progress. Achievers follow net worth growth and milestone completion rates. Connectors measure generosity percentage and relationship investment quality. Visionaries assess alignment between spending and values plus progress toward vision. Optimizers track efficiency gains and value maximization across categories.

Troubleshooting Common Obstacles

When systems fail, assess whether the method misaligns with your personality or requires minor adjustments. Distinguish between necessary discomfort of change and fundamental incompatibility with your nature. Seek support from communities of people sharing your financial personality. Consider professional guidance from advisors understanding personality-based approaches. Remember that consistency with an imperfect system beats perfection with an abandoned one.

10. Advanced Strategies for Financial Personality Types

Once you’ve established basic systems aligned with your personality, advanced strategies accelerate progress toward financial goals.

Leveraging Your Personality Strengths

Analytical planners can optimize complex strategies like tax-loss harvesting, mega backdoor Roths, and sophisticated asset allocation. Freedom seekers excel at generating additional income through flexible side hustles and entrepreneurial ventures. Guardians build comprehensive risk management through estate planning, appropriate insurance, and multiple safety nets. Achievers rapidly build wealth through focused goal pursuit and strategic career advancement. Connectors develop valuable networks opening doors to opportunities and collaborations. Visionaries identify emerging trends and innovative approaches others miss. Optimizers systematically increase income while controlling lifestyle inflation maximizing savings rates.

Mitigating Personality-Based Weaknesses

Every financial personality includes blind spots requiring conscious attention and mitigation strategies. Analytical planners must guard against paralysis and over-optimization preventing action. Freedom seekers need systems ensuring long-term security doesn’t suffer from present-focused spontaneity. Guardians should gradually increase risk tolerance preventing inflation from eroding purchasing power. Achievers must balance aggressive goals with sustainable pace and quality of life. Connectors require clear boundaries preventing generosity from undermining personal financial security. Visionaries need implementation partners and accountability ensuring follow-through. Optimizers should recognize diminishing returns on optimization efforts.

Evolving Your Money Strategy

Your optimal money strategy shifts as your financial situation, life stage, and goals evolve over time. Review your approach annually assessing whether current systems still serve you effectively. Major life events like marriage, children, career changes, or inheritance warrant strategy reassessment. Economic conditions may temporarily require emphasizing different personality traits. Stay curious about new approaches while maintaining core alignment with your fundamental personality.

Conclusion: Your Path to Financial Success Through Self-Knowledge

The most powerful money strategy isn’t found in following someone else’s perfect system—it’s discovered by understanding yourself deeply and designing approaches that work with your natural tendencies. Financial success becomes inevitable when your methods align with your personality rather than fighting against it.

Traditional financial advice fails most people precisely because it ignores personality differences treating everyone as identical rational actors. The reality is messier and more human. You are not a spreadsheet. Your emotions, values, and natural inclinations profoundly influence your financial behaviors whether you acknowledge them or not. The question isn’t whether personality affects your money strategy—it’s whether you’ll work with your personality or against it.

This guide provides frameworks for understanding your financial personality and implementing compatible strategies. Now comes the essential work: honest self-assessment, thoughtful system design, and consistent implementation. Choose the approaches resonating most strongly with your natural tendencies. Give them time to work before abandoning ship. Adjust based on results rather than perfectionistic ideals.

Your money strategy should feel sustainable rather than suffocating, empowering rather than restricting, and aligned with your deepest values rather than fighting them. When you discover the approach matching your personality, money management transforms from dreaded obligation into satisfying practice supporting your broader life goals. Financial peace isn’t achieved by forcing yourself into someone else’s system—it’s found by creating your own.

Also read this:

How to Make Your First Monthly Earnings Online Quickly: A Practical Blueprint for Beginners

Creative Side Hustles You Can Start Right After Reading This: Turn Your Talents Into Income Today