Albert Einstein allegedly called it “the eighth wonder of the world,” and Warren Buffett built his fortune upon its foundation. Compound interest is the most powerful wealth-building force available to everyday people, yet most individuals fail to harness its true potential. Whether you’re just starting your financial journey or looking to accelerate existing wealth, understanding how to leverage compound interest can transform modest savings into substantial fortunes over time.

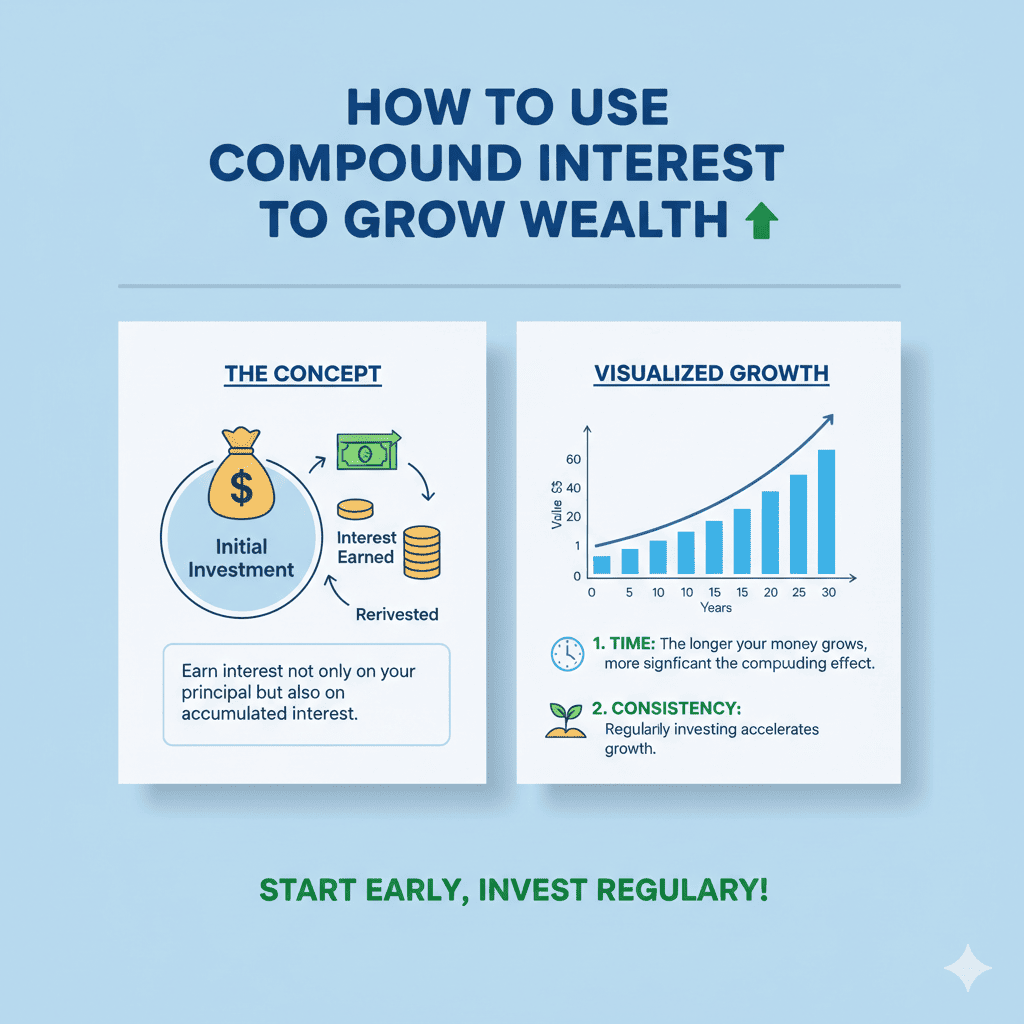

The magic of compound interest lies in its exponential nature. Unlike simple interest that grows linearly, compound interest creates a snowball effect where your money earns returns, and those returns generate their own returns, creating accelerating growth that becomes increasingly dramatic over time. This mathematical phenomenon explains how consistent savers can accumulate more wealth than high earners who spend everything they make.

Despite its tremendous power, compound interest remains poorly understood by many. People underestimate how small amounts can grow into large sums, fail to start early enough, or make costly mistakes that interrupt the compounding process. The difference between those who retire wealthy and those who struggle financially often comes down to whether they understood and applied the principles of compound interest consistently throughout their lives.

This comprehensive guide reveals everything you need to know about using compound interest to build lasting wealth. From understanding the mathematics behind exponential growth to implementing specific strategies that maximize compounding in different financial vehicles, these proven principles will help you harness one of the most reliable paths to financial freedom ever discovered.

Understanding the Mathematics of Compound Interest

Before implementing wealth-building strategies, you need to understand exactly how compound interest works and why it’s so powerful. The mathematics behind compounding reveals why starting early and staying consistent matters more than almost any other factor in wealth accumulation.

The Compound Interest Formula

The mathematical formula for compound interest is:

A = P(1 + r/n)^(nt)

Where:

- A = Final amount

- P = Principal (initial investment)

- r = Annual interest rate (as a decimal)

- n = Number of times interest compounds per year

- t = Number of years

This formula demonstrates that compound interest grows exponentially rather than linearly. The (nt) exponent creates the accelerating growth that makes compounding so powerful over long periods.

Simple vs. Compound Interest: The Critical Difference

Understanding the difference between simple and compound interest illuminates why compounding is so transformative:

Simple Interest calculates returns only on your original principal. If you invest $10,000 at 8% simple interest for 30 years, you earn $800 annually, totaling $24,000 in interest for a final balance of $34,000.

Compound Interest calculates returns on your principal PLUS all accumulated interest. That same $10,000 at 8% compound interest for 30 years grows to $100,627—nearly three times the simple interest result. The difference of $66,627 comes entirely from interest earning its own interest.

This dramatic difference explains why understanding and maximizing compound interest is essential for anyone serious about building wealth.

The Rule of 72

The Rule of 72 provides a quick mental calculation for understanding compound growth. Divide 72 by your annual return percentage to estimate how many years it takes your money to double.

Examples:

- 8% return: 72 ÷ 8 = 9 years to double

- 10% return: 72 ÷ 10 = 7.2 years to double

- 6% return: 72 ÷ 6 = 12 years to double

This simple rule helps you quickly evaluate investment opportunities and understand the timeline for your wealth accumulation when leveraging compound interest.

The Time Value of Money

Compound interest demonstrates that money available today is worth more than the same amount in the future because of its earning potential. A dollar invested today at 8% will grow to $2.16 in 10 years, $4.66 in 20 years, and $10.06 in 30 years. This exponential growth is why starting early matters so dramatically.

Frequency of Compounding Matters

How often interest compounds significantly impacts growth. The same principal and rate produce different results based on compounding frequency:

$10,000 at 8% for 20 years:

- Annually: $46,610

- Quarterly: $48,595

- Monthly: $49,268

- Daily: $49,530

While the differences seem modest, over longer periods and larger principals, compounding frequency can add thousands or even tens of thousands to your wealth. When choosing investments or accounts, understanding how compound interest is calculated helps you maximize returns.

1. Start Early to Maximize the Power of Time

The single most important factor in leveraging compound interest is time. Starting early—even with small amounts—beats starting late with large amounts because of compound interest’s exponential nature. Understanding this principle transforms how you approach saving and investing.

The Early Start Advantage

Consider two scenarios illustrating why early starts dominate large contributions:

Scenario A – Early Emma: Starts investing $200 monthly at age 25. Stops completely at age 35. Total invested: $24,000 over 10 years. At 8% annual return, her investments grow to $523,113 by age 65.

Scenario B – Late Larry: Starts investing $200 monthly at age 35. Continues until age 65. Total invested: $72,000 over 30 years. At the same 8% return, his investments grow to $298,071 by age 65.

Despite investing three times more money, Late Larry accumulates $225,042 LESS than Early Emma. The decade head start gave Emma’s money twenty extra years of compounding, creating dramatically more wealth despite smaller total contributions.

This example illustrates why understanding compound interest makes starting today—regardless of your age—the most important wealth-building decision you can make.

The Cost of Delay

Every year you delay starting costs exponentially more wealth. Consider a 25-year-old who could invest $300 monthly:

- Starting at 25: $878,570 at age 65 (assuming 8% returns)

- Starting at 30: $577,362 at age 65

- Starting at 35: $375,073 at age 65

- Starting at 40: $240,365 at age 65

Each five-year delay reduces final wealth by roughly 35-40%. The first five-year delay (25 to 30) costs over $300,000 in final wealth. This dramatic impact shows why harnessing compound interest early matters more than almost any other financial decision.

Starting Small Beats Waiting to Start Big

Many people delay investing because they feel their contributions are too small to matter. This thinking fundamentally misunderstands compound interest. Small amounts started early almost always beat large amounts started late.

$100 monthly from age 25 to 65 at 8% = $351,428 $300 monthly from age 40 to 65 at 8% = $240,365

The person investing one-third as much accumulates 46% MORE wealth simply by starting fifteen years earlier. When it comes to compound interest, time matters more than amount.

Teaching Children About Compound Interest

Parents can give children enormous advantages by introducing compound interest concepts early. Opening custodial investment accounts, matching children’s savings, or simply demonstrating compound growth with real money teaches invaluable lessons.

A child who invests $1,000 at age 10 and never adds another dollar will have $31,920 at age 65 (assuming 7% returns). That single $1,000 investment grows into retirement money through nothing but compound interest and time.

The Psychological Advantage of Early Starts

Starting early creates psychological momentum. Watching your wealth grow—even slowly at first—motivates continued contributions and smart financial decisions. Early starters develop investing habits and financial discipline that serve them throughout life, while late starters often struggle to catch up both mathematically and psychologically.

2. Contribute Consistently and Increase Investments Over Time

While starting early provides the foundation, consistent contributions and strategic increases accelerate compound interest dramatically. Regular investing creates multiple compounding cycles simultaneously, each contributing to exponential growth.

Dollar-Cost Averaging

Investing fixed amounts at regular intervals—monthly, quarterly, or annually—harnesses compound interest while reducing investment timing risk. This approach, called dollar-cost averaging, provides several advantages:

Market Volatility Protection: Regular investing means you buy more shares when prices are low and fewer when prices are high, averaging your cost basis over time.

Eliminates Timing Decisions: You avoid the impossible task of predicting market tops and bottoms, instead investing consistently regardless of conditions.

Builds Discipline: Automated regular investments create habits that persist regardless of emotional market reactions or life circumstances.

Multiple Compounding Cycles: Each contribution starts its own compounding journey, creating layered growth across different time horizons.

The Power of Consistency

Consistency matters more than contribution size when leveraging compound interest. Consider these scenarios over 30 years at 8% returns:

Inconsistent Investor: Invests $500 monthly for 10 years, then stops. Total invested: $60,000. Final value: $328,988.

Consistent Investor: Invests $200 monthly for entire 30 years. Total invested: $72,000. Final value: $298,071.

Super Consistent Investor: Invests $200 monthly for 30 years AND never sells during downturns. Final value significantly higher due to uninterrupted compounding.

The investor who maintains consistency through all market conditions—never stopping contributions during bear markets or recessions—maximizes compound interest by never interrupting the compounding process.

Annual Contribution Increases

Implementing systematic increases to your contributions supercharges compound interest. A modest annual increase creates dramatic long-term differences:

Base Scenario: $300 monthly for 30 years at 8% = $447,107

Growth Scenario: Starting at $300 monthly, increasing 5% annually for 30 years at 8% = $827,364

The growth scenario accumulates 85% more wealth despite total contributions increasing by only 64%. This demonstrates how strategic contribution increases leverage compound interest exponentially.

Windfall Investment Strategy

Rather than spending bonuses, tax refunds, inheritances, or other windfalls, investing them creates massive long-term wealth. A $5,000 windfall invested at age 35 grows to $50,313 by age 65 at 8% returns—ten times the original amount through compound interest alone.

Automate Your Investments

Automation removes willpower from the equation, ensuring consistent contributions regardless of circumstances. Set up automatic transfers from checking to investment accounts immediately after payday. This “pay yourself first” approach prioritizes wealth building and maximizes the time your money spends compounding.

When contributions are automated, you harness compound interest without requiring ongoing decisions, discipline, or effort. The system works automatically, building wealth while you focus on other aspects of life.

3. Maximize Returns Through Strategic Asset Allocation

The rate of return dramatically impacts how effectively compound interest builds your wealth. Small differences in returns create enormous differences in final wealth over long periods. Strategic asset allocation optimizes returns while managing risk appropriate to your timeline and goals.

Understanding Different Return Rates

The power of compound interest multiplies dramatically with higher returns:

$500 monthly for 30 years:

- 4% return: $346,724

- 6% return: $502,257

- 8% return: $745,179

- 10% return: $1,130,244

Moving from 4% to 10% returns more than triples final wealth despite identical contributions. This demonstrates why maximizing returns—while maintaining appropriate risk—is essential for leveraging compound interest effectively.

Stock Market Historical Returns

Historically, the stock market has provided the highest long-term returns of major asset classes:

- Large-cap stocks: ~10% average annual returns

- Small-cap stocks: ~12% average annual returns

- Bonds: ~5-6% average annual returns

- Cash/Savings accounts: ~1-2% average annual returns

While past performance doesn’t guarantee future results, these historical patterns show why stock-heavy portfolios typically maximize compound interest for long-term investors who can tolerate volatility.

The Age-Based Allocation Model

Traditional advice suggests holding a stock percentage equal to 100 or 110 minus your age, with the remainder in bonds:

- Age 25: 75-85% stocks, 15-25% bonds

- Age 45: 55-65% stocks, 35-45% bonds

- Age 65: 35-45% stocks, 55-65% bonds

This approach maximizes growth (and compound interest) during accumulation years while gradually reducing volatility as retirement approaches.

Index Fund Advantages

Low-cost index funds provide excellent vehicles for compound growth:

Lower Fees: Expense ratios of 0.03-0.15% versus 1-2% for actively managed funds. Over decades, fee differences dramatically impact compound growth.

Market Returns: Index funds match market performance, which historically beats most active managers over long periods.

Diversification: Single index funds provide exposure to hundreds or thousands of companies, reducing individual company risk.

Tax Efficiency: Lower turnover creates fewer taxable events, allowing more money to remain invested and compounding.

When maximizing compound interest, minimizing fees keeps more money working for you rather than enriching fund companies.

Dividend Reinvestment

Dividends provide powerful compounding fuel when reinvested rather than taken as cash. Companies paying dividends typically increase them over time, creating growing income streams that reinvest to purchase more shares, generating more dividends—a virtuous cycle of compound interest.

Historical data shows approximately 40% of total stock market returns come from reinvested dividends. Failing to reinvest dividends significantly reduces the compounding power of your investments.

Rebalancing for Optimal Returns

Periodic rebalancing maintains your target allocation while forcing you to “sell high and buy low.” When stocks surge, rebalancing sells appreciated equities and buys undervalued bonds. When stocks fall, rebalancing buys discounted stocks using bond allocations.

This disciplined approach enhances returns while managing risk, ensuring your portfolio remains optimized for maximum compound interest over time.

4. Leverage Tax-Advantaged Accounts to Turbocharge Compounding

Taxes represent one of the biggest drags on compound interest. Tax-advantaged retirement accounts eliminate or defer taxes, allowing your money to compound faster by keeping more returns invested rather than paying taxes annually.

401(k) and 403(b) Accounts

Employer-sponsored retirement plans offer unmatched advantages for building wealth through compound interest:

Pre-Tax Contributions: Money invested reduces current taxable income, lowering your tax bill immediately while investing more.

Employer Matching: Free money that immediately increases your investment and begins compounding. A 50% match on 6% contributions equals an instant 50% return before any market gains.

Tax-Deferred Growth: No taxes on gains, dividends, or interest until withdrawal. This allows 100% of returns to remain invested and compounding.

Higher Contribution Limits: $23,000 annually (2024 limits) plus $7,500 catch-up contributions for those 50+, allowing substantial wealth accumulation.

A 25-year-old investing $10,000 annually in a tax-deferred 401(k) earning 8% will accumulate $2,799,061 by age 65. The same contributions in a taxable account (assuming 24% tax bracket) would grow to approximately $1,850,000—nearly $1 million less due to annual tax drag on compound interest.

Traditional and Roth IRAs

Individual Retirement Accounts provide additional tax-advantaged space for compound growth:

Traditional IRA: Pre-tax contributions (if income-eligible), tax-deferred growth, taxable withdrawals in retirement. Best for those expecting lower retirement tax brackets.

Roth IRA: After-tax contributions, tax-free growth, tax-free withdrawals in retirement. Ideal for younger investors in lower brackets now who expect higher incomes later.

The power of compound interest in Roth IRAs is particularly dramatic since qualified withdrawals are completely tax-free. A 25-year-old investing $6,500 annually in a Roth IRA at 8% returns will have $2,125,729 at age 65—completely tax-free.

Health Savings Accounts (HSAs)

HSAs offer triple tax advantages unmatched by any other account:

- Pre-tax contributions reduce current taxable income

- Tax-free growth with no taxes on investment gains

- Tax-free withdrawals for qualified medical expenses

For investors using HSAs as retirement savings vehicles (not just for current medical expenses), this triple tax advantage makes HSAs one of the most powerful compound interest tools available. A 30-year-old maximizing HSA contributions could accumulate over $500,000 tax-free by age 65.

529 Education Savings Plans

For parents building education funds, 529 plans offer state tax deductions on contributions and tax-free growth and withdrawals for education expenses. Starting a 529 when children are born and contributing regularly harnesses compound interest to fund education without loans.

Example: $250 monthly from birth to age 18 at 7% returns grows to $115,000—enough for four years at many public universities, all funded through compound growth.

Taxable Brokerage Accounts

Once you maximize tax-advantaged spaces, taxable brokerage accounts provide additional investment capacity. While lacking special tax treatment, these accounts offer:

- No contribution limits

- No withdrawal penalties or age restrictions

- Access to funds for goals before retirement age

- Tax-loss harvesting opportunities

Tax-efficient investing strategies in taxable accounts—holding index funds, minimizing turnover, and strategically realizing losses—minimize tax drag on compound interest even without special account benefits.

5. Avoid Common Mistakes That Destroy Compound Interest

Understanding what accelerates compound interest matters, but avoiding mistakes that destroy compounding is equally critical. These common errors interrupt the compounding process, costing enormous wealth over time.

Withdrawing Early from Retirement Accounts

Early withdrawals from retirement accounts trigger taxes plus 10% penalties, and more devastatingly, stop compound interest on withdrawn funds. A $10,000 early withdrawal at age 35 costs not just $10,000 plus penalties—it costs the $100,626 that money would have become by age 65 at 8% returns.

Beyond the immediate financial cost, early withdrawals create psychological patterns of treating retirement savings as accessible money rather than untouchable wealth-building tools.

Stopping Contributions During Market Downturns

Many investors panic during market declines and stop contributing or, worse, sell at losses. This behavior is devastating to long-term compound interest:

Market downturns offer discount prices: Continuing contributions during bear markets buys more shares at lower prices, which generate higher returns during recovery.

Selling locks in losses: Markets have historically recovered from every downturn. Selling during declines makes temporary paper losses permanent and stops compound interest entirely.

Missing best days: Market recoveries often happen suddenly. Missing just the 10 best market days over 30 years reduces returns by approximately 50%.

Maintaining discipline during volatility—continuing contributions and never selling—maximizes compound interest over complete market cycles.

High Fees and Expenses

Investment fees may seem small but devastate compound growth over time. Consider two investors, each starting with $100,000 and adding $10,000 annually for 30 years:

Low-Fee Investor (0.10% expense ratio): Final value of $1,917,216 High-Fee Investor (1.50% expense ratio): Final value of $1,432,690

The high-fee investor loses $484,526—over 25% of final wealth—to fees. This demonstrates how even seemingly modest fees dramatically reduce compound interest over long periods.

Not Reinvesting Dividends and Distributions

Taking dividends as cash rather than reinvesting interrupts compound growth. As discussed earlier, roughly 40% of long-term stock returns come from reinvested dividends. Spending dividends eliminates this entire component of compound interest.

Excessive Trading and Market Timing

Frequent trading generates taxes, fees, and typically worse returns than buy-and-hold strategies. Studies consistently show that investors who trade frequently underperform those who invest and hold long-term.

Market timing—attempting to buy at bottoms and sell at tops—is notoriously difficult even for professionals. The resulting mistakes interrupt compound interest and reduce returns below what simple consistent investing would have achieved.

Insufficient Diversification

Concentrating investments in single stocks, sectors, or asset classes exposes you to unnecessary risk. Company bankruptcies, sector crashes, or asset class underperformance can devastate concentrated portfolios, interrupting compound interest for years or permanently.

Broad diversification protects your compounding engine from single-point failures while maintaining growth potential.

Emotional Decision Making

Fear and greed drive poor investment decisions. Panic selling during downturns and exuberant buying during bubbles are both costly. Emotional decisions interrupt the patient, disciplined approach that compound interest requires to work its magic.

Creating and following a written investment plan, maintaining preset rebalancing schedules, and automating contributions removes emotion from the process, protecting compound growth from self-destructive behavior.

6. Apply Compound Interest Beyond Traditional Investments

While compound interest is most commonly discussed regarding financial investments, the same principles apply across many wealth-building domains. Understanding these broader applications multiplies your wealth-building potential.

Compounding Knowledge and Skills

Learning compounds like interest. Skills build upon previous skills, creating accelerating expertise. An hour studying today makes tomorrow’s hour more productive. This intellectual compound interest increases earning potential exponentially over careers.

Investing in education, courses, certifications, or skill development generates returns that compound throughout your career as increased skills command higher income, which provides more capital for financial investments, creating a virtuous cycle.

Business and Entrepreneurship

Business profits reinvested into growth create compound interest in business value. Revenue reinvested in marketing generates more customers, producing more revenue to reinvest—an exponential growth engine mirroring financial compounding.

Successful entrepreneurs understand this principle, often living modestly while reinvesting profits during growth phases, allowing their businesses to compound in value before eventually providing substantial income or sale proceeds.

Real Estate Equity

Real estate mortgages create forced savings through principal reduction. Each payment reduces the loan balance, increasing your equity. This equity growth compounds with property appreciation, creating wealth through two simultaneous mechanisms.

Additionally, real estate cash flow can be reinvested into additional properties, creating portfolio compound interest as growing rental income funds new acquisitions, which generate more income, funding more acquisitions—exponential portfolio growth.

Network Effects

Your professional and personal network grows through compound effects. Each valuable connection can introduce you to additional connections, opportunities, or resources. Strategic networking creates compound interest in relationships, opportunities, and social capital.

Compound Habits

Small positive habits compound into transformative life changes. Reading 20 pages daily seems modest but accumulates to 30+ books annually. Daily exercise seems like tiny progress but compounds into dramatic health improvements. Small savings percentages compound into wealth.

The principle of compound interest teaches that small, consistent actions maintained over long periods create enormous results—a lesson applicable far beyond financial markets.

Health as Compound Interest

Health behaviors compound over lifetimes. Daily healthy choices create incremental improvements that compound into dramatically better health outcomes. Conversely, poor health choices compound into serious problems.

Understanding health through a compound interest lens motivates consistent healthy behaviors by illuminating long-term consequences of daily decisions.

Conclusion: Your Compound Interest Journey Starts Now

Understanding compound interest provides the blueprint for building substantial wealth regardless of your starting point. While the mathematics is simple, the discipline to harness compounding consistently over decades separates those who achieve financial freedom from those who perpetually struggle.

The most important lessons about compound interest are:

Start immediately: Time is the most powerful variable in compound growth. Every day you delay costs exponentially more wealth. Start today with whatever amount you can, even if it seems insignificant.

Stay consistent: Regular contributions matter more than size. Consistent small amounts beat inconsistent large amounts. Automate your contributions to ensure consistency regardless of circumstances.

Maximize returns: Higher returns dramatically accelerate compound growth. Invest in growth assets appropriate to your timeline and risk tolerance.

Minimize costs: Fees and taxes destroy compounding. Use low-cost investments and tax-advantaged accounts to keep more money compounding.

Never interrupt the process: The most costly mistakes all involve stopping the compounding process—withdrawing early, selling during downturns, or stopping contributions. Maintain discipline through all market conditions.

Think long-term: Compound interest requires patience. Short-term thinking leads to decisions that destroy long-term compounding. Maintain multi-decade perspectives.

The wealth gap between those who understand and apply compound interest principles and those who don’t is staggering. Two people with identical incomes can end up with net worths differing by millions based purely on whether they harnessed compound interest starting in their twenties.

Your financial future isn’t determined by your income—it’s determined by whether you understand and consistently apply the principles of compound interest. The good news is that anyone can do this. You don’t need special knowledge, insider connections, or large starting capital. You need time, consistency, and discipline.

Whether you’re 20 or 50, employed or entrepreneurial, wealthy or just starting, the principles of compound interest work the same. The sooner you start applying them, the more wealth you’ll accumulate. But regardless of when you start, starting is infinitely better than never beginning.

Make the decision today to harness compound interest for your financial future. Open the accounts. Automate the contributions. Choose appropriate investments. Then maintain consistency and patience while compound interest works its mathematical magic, transforming modest contributions into substantial wealth.

Also read this:

How to Build a Personal Brand from Scratch in 2025