International travel opens doors to incredible experiences, but it also exposes you to risks that don’t exist in your home country. Medical emergencies, trip cancellations, lost luggage, and unexpected events can transform dream vacations into financial nightmares without proper protection. Travel insurance provides essential safety nets, yet many travelers either skip coverage entirely or purchase inadequate policies that fail when needed most. Learning to choose the right travel insurance represents one of the most important decisions in trip planning, potentially saving thousands of dollars and providing peace of mind throughout your journey.

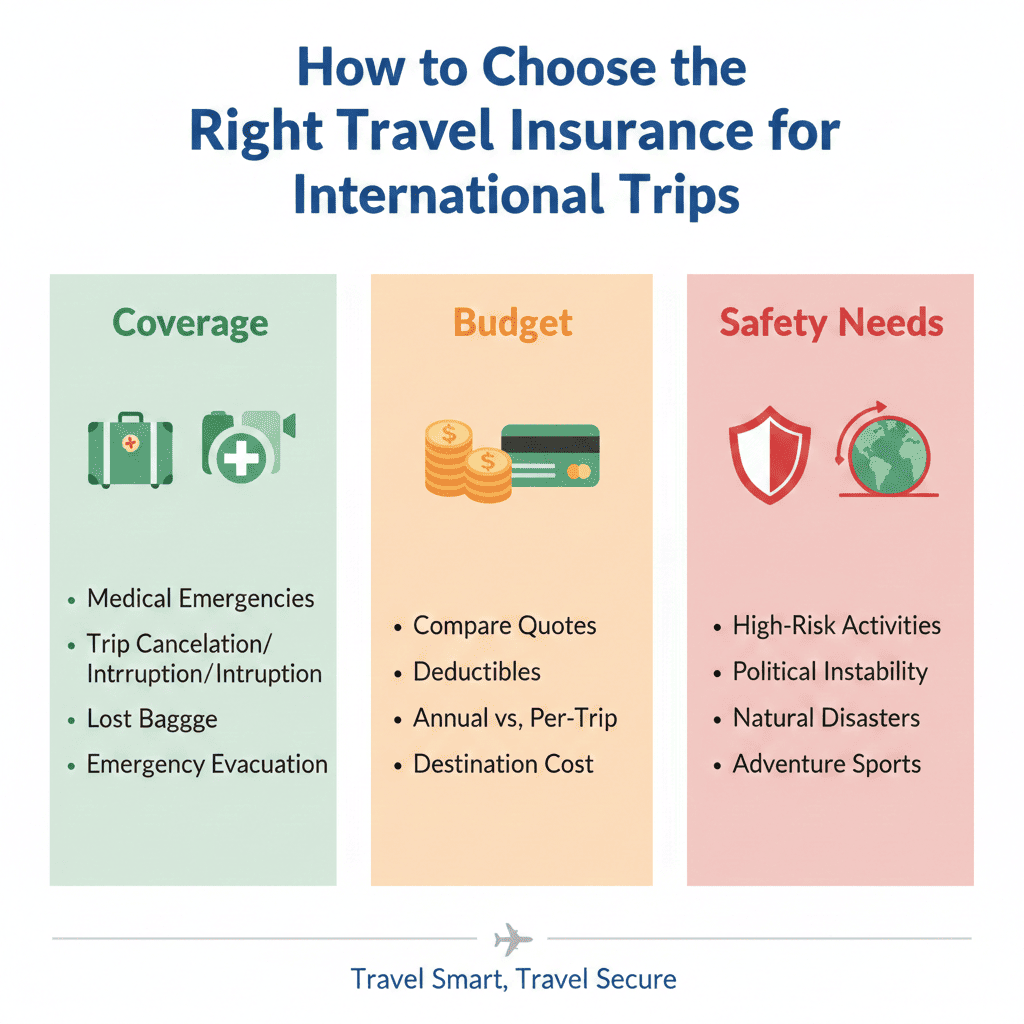

The travel insurance market offers overwhelming choices, from basic medical coverage to comprehensive policies protecting against dozens of scenarios. Prices vary dramatically, coverage details confuse even experienced travelers, and fine print often conceals critical exclusions. This comprehensive guide demystifies travel insurance, helping you understand what coverage you actually need, how to evaluate policies effectively, and how to choose the right travel insurance that balances comprehensive protection with reasonable costs. Whether you’re planning a weekend getaway or a six-month adventure, understanding travel insurance essentials ensures you’re properly protected without overpaying for unnecessary coverage.

1. Understanding What Travel Insurance Actually Covers

Travel insurance isn’t a single product but rather a collection of different coverages bundled together. Understanding each component helps you choose the right travel insurance for your specific needs rather than purchasing generic policies that may include unnecessary features while excluding what you actually require.

Medical and Emergency Medical Evacuation Coverage

Medical coverage represents the most critical travel insurance component, paying for doctor visits, hospital stays, emergency treatments, and prescriptions when you become ill or injured abroad. Your domestic health insurance typically provides limited or no coverage outside your home country, leaving you personally responsible for potentially astronomical medical bills.

Emergency medical evacuation coverage pays for transportation to appropriate medical facilities when local hospitals cannot provide necessary treatment. This might involve air ambulances, medical escorts, or repatriation to your home country. Medical evacuations easily cost fifty thousand to one hundred thousand dollars or more, making this coverage essential for travelers visiting remote areas or countries with limited healthcare infrastructure.

Standard policies typically offer medical coverage ranging from fifty thousand to five hundred thousand dollars, with higher limits available for additional premiums. Evaluate your destination’s healthcare costs when selecting limits, as medical care in countries like the United States, Switzerland, or Japan costs significantly more than in Southeast Asia or Central America.

Trip Cancellation and Interruption Protection

Trip cancellation coverage reimburses prepaid, non-refundable expenses when you must cancel your trip before departure for covered reasons. These typically include illness or injury to you or immediate family members, death of family members, natural disasters affecting your destination, jury duty, job loss, or other specified events.

Trip interruption coverage provides similar protection if you must cut your trip short after departure, reimbursing unused prepaid expenses and additional costs to return home early. This coverage becomes particularly valuable for expensive trips with significant advance deposits or non-refundable bookings.

Coverage limits typically equal your total trip cost, including flights, accommodations, tours, and other prepaid expenses. Read covered reasons carefully, as policies vary significantly in what situations trigger reimbursement.

Baggage and Personal Belongings Protection

Baggage coverage reimburses you for lost, stolen, or damaged luggage and personal items. Most policies include per-item limits, often capping individual item reimbursement at two hundred fifty to five hundred dollars regardless of actual value. This means expensive cameras, laptops, or jewelry may not be fully covered.

Baggage delay coverage provides reimbursement for essential items when your luggage is delayed beyond specified timeframes, typically twelve to twenty-four hours. This helps purchase toiletries, medications, and clothing while awaiting your bags.

Airlines provide limited liability for lost luggage, but their reimbursement often proves inadequate for valuable belongings. Travel insurance supplements airline coverage but requires documentation of items and proof of value for significant reimbursements.

Travel Delay and Missed Connection Coverage

Travel delay coverage reimburses additional expenses including meals, accommodations, and transportation when your trip is delayed beyond specified periods due to weather, mechanical breakdowns, or other covered reasons. Most policies require delays of six to twelve hours before coverage activates.

Missed connection coverage helps when you miss connecting flights due to delays on previous segments, paying for alternative transportation, accommodations, and meals until you reach your destination.

Additional Coverage Types

Cancel for any reason coverage, available as policy upgrades, allows trip cancellation for reasons not typically covered under standard policies. This flexibility costs significantly more and usually reimburses only fifty to seventy-five percent of trip costs, but provides maximum flexibility for travelers with unpredictable situations.

Rental car damage coverage, adventure sports coverage, political evacuation, and identity theft assistance represent additional options available through comprehensive policies or as separate riders.

2. Assessing Your Personal Travel Insurance Needs

Not every traveler requires the same coverage. Learning to choose the right travel insurance begins with honest assessment of your specific circumstances, travel style, destinations, and existing coverage through other sources.

Evaluating Your Health and Medical Needs

Your age, health status, and medical history significantly influence insurance needs. Travelers with pre-existing conditions require policies specifically covering those conditions, often available only through comprehensive plans purchased shortly after making initial trip deposits. Older travelers face higher medical risks and should prioritize generous medical coverage limits.

Consider your destination’s healthcare quality and costs. Travelers visiting countries with excellent public healthcare like many European nations face different risks than those visiting developing countries with limited medical infrastructure. Remote destinations far from quality medical facilities make emergency evacuation coverage absolutely essential.

Active travelers planning adventure activities including skiing, scuba diving, or mountain climbing need policies explicitly covering these activities, as many standard policies exclude them as high-risk pursuits.

Analyzing Your Trip Investment

The more money you’ve invested in non-refundable bookings, the more important trip cancellation and interruption coverage becomes. All-inclusive resort packages, cruise deposits, and advance tour bookings represent significant financial risks if you cannot travel as planned.

Budget travelers using refundable accommodations and flexible tickets face less cancellation risk, potentially justifying medical-only policies rather than comprehensive coverage. However, even budget travelers should consider costs of rebooking flights or finding last-minute accommodations if plans change.

Reviewing Existing Coverage

Many travelers already possess some travel insurance coverage through various sources without realizing it. Credit cards, particularly premium travel cards, often include trip cancellation, trip delay, baggage delay, and rental car coverage when you use the card to purchase travel. Review your card benefits carefully, noting coverage limits and requirements.

Some domestic health insurance plans provide limited international coverage, particularly in neighboring countries. Medicare typically provides no coverage outside the United States, while some private plans offer emergency coverage abroad with limitations.

Homeowners or renters insurance may cover personal belongings even when traveling, though coverage limits and deductibles affect whether this provides adequate protection. Contact your insurance provider to understand exactly what coverage extends to international travel.

Considering Trip Duration and Frequency

Single-trip policies suit occasional travelers, providing coverage for one specific journey. Annual multi-trip policies make more sense for frequent travelers, covering unlimited trips within a year up to specified maximum trip durations, typically thirty to ninety days per trip.

Long-term travelers, digital nomads, and extended backpackers require specialized long-term or expat insurance rather than standard vacation policies. These plans provide continuous coverage for months or years abroad, functioning more like international health insurance than trip-specific policies.

3. Understanding Policy Exclusions and Limitations

Travel insurance policies contain numerous exclusions that prevent coverage in specific situations. Understanding these limitations helps you choose the right travel insurance and avoid unpleasant surprises when filing claims.

Common Policy Exclusions

Pre-existing medical conditions represent the most significant exclusion in travel insurance. Most standard policies exclude coverage for any medical issues diagnosed or treated within a lookback period, typically sixty to one hundred eighty days before purchasing insurance. Some insurers offer waivers covering pre-existing conditions if you purchase comprehensive coverage within a specified timeframe after making your initial trip deposit, usually fourteen to twenty-one days.

High-risk activities including skydiving, bungee jumping, mountain climbing above certain elevations, and extreme sports are routinely excluded from standard policies. Travelers planning these activities must purchase specialized adventure sports coverage or specific activity riders.

Mental health and substance abuse treatments face limitations or exclusions in many policies. Injuries or illnesses related to alcohol or drug use typically aren’t covered, nor are situations where you were engaging in illegal activities.

Travel to countries under travel warnings or advisories from your government often voids coverage. Wars, civil unrest, terrorism, and pandemic-related situations face complex coverage rules that vary significantly between policies, particularly relevant given recent global events.

Understanding Coverage Limits and Sub-Limits

Even when situations are covered, policies impose maximum payout limits. Overall policy limits cap total benefits available across all coverage types, while sub-limits restrict specific categories. For example, a policy might offer one hundred thousand dollars in total coverage but limit baggage claims to two thousand dollars and individual items to five hundred dollars.

Per-day limits often apply to travel delay and baggage delay coverage, capping reimbursement amounts regardless of actual expenses. Understand these limits when evaluating whether coverage adequately protects your potential losses.

Geographic Restrictions and Travel Warnings

Most policies exclude coverage in countries subject to government travel warnings advising against all travel. Coverage for destinations with lower-level advisories varies by insurer. Always verify your destination’s status and how it affects coverage before purchasing insurance.

Some policies exclude coverage in specific countries or regions entirely, particularly areas with ongoing conflicts or political instability. United States citizens may find policies excluding coverage in Cuba, North Korea, or other restricted destinations.

Time Limitations and Reporting Requirements

Policies typically require reporting incidents within specific timeframes to maintain coverage eligibility. Lost or stolen items usually must be reported to local police immediately and to the insurer within twenty-four to seventy-two hours. Medical treatments may require pre-approval for non-emergency situations.

Understand deadlines for filing claims and providing documentation. Missing deadlines can result in claim denials even for otherwise covered situations.

4. Comparing Travel Insurance Providers and Policies

The travel insurance market includes dozens of providers offering hundreds of policy variations. Effective comparison helps you choose the right travel insurance at competitive prices while ensuring adequate coverage.

Major Travel Insurance Providers

Well-established insurers including Allianz Global Assistance, Travel Guard, World Nomads, InsureMyTrip, and Travelex Insurance Services dominate the market. Each offers multiple policy tiers from basic medical-only coverage to comprehensive plans with extensive benefits.

Specialized providers like World Nomads cater to adventure travelers and long-term backpackers, offering flexible coverage for extended trips and high-risk activities. GeoBlue and IMG Global focus on international medical coverage for expats and long-term travelers.

Credit card travel insurance, while convenient, typically provides secondary coverage rather than primary, meaning you must file claims with other insurance first before credit card coverage applies. This creates administrative hassles during already stressful situations.

Key Factors for Comparison

Medical coverage limits should top your comparison list, ensuring adequate protection for your destination’s healthcare costs. Fifty thousand dollars might suffice in Thailand but proves inadequate for medical emergencies in the United States.

Emergency evacuation coverage deserves careful evaluation, as this single benefit can justify entire policy costs. Ensure unlimited or very high limits for evacuation coverage, as costs vary dramatically based on your location and required transportation.

Compare covered reasons for trip cancellation and interruption carefully. Some policies offer extensive lists including job loss, home damage, and travel supplier bankruptcy, while others limit coverage to illness, injury, and death.

Review deductibles, which are amounts you pay before insurance coverage begins. Higher deductibles reduce premiums but increase out-of-pocket costs if you file claims. Balance premium savings against your ability to absorb deductible amounts.

Using Comparison Tools Effectively

Insurance comparison websites like InsureMyTrip, Squaremouth, and QuoteWright allow side-by-side policy comparisons based on your trip details. Input accurate information about your age, trip cost, destination, and dates to receive relevant quotes.

These platforms provide independent reviews and ratings, helping identify reliable insurers with good claims payment records. Customer service quality and claims processing efficiency matter enormously when you need assistance during emergencies.

Read actual policy documents rather than relying solely on marketing summaries. Certificate of insurance documents contain complete terms, conditions, and exclusions governing your coverage.

Understanding Price Variations

Travel insurance typically costs between four and ten percent of total trip costs, though prices vary based on age, trip duration, destination, coverage levels, and deductibles. Comprehensive policies with high coverage limits and low deductibles cost more than basic medical-only plans.

Age significantly affects pricing, with travelers over sixty-five paying substantially higher premiums due to increased medical risks. Pre-existing condition waivers, cancel for any reason coverage, and adventure sports riders all increase costs.

Don’t automatically choose the cheapest policy. Inadequate coverage that leaves you financially exposed costs far more than premium differences between basic and comprehensive plans.

5. Special Considerations for Different Types of Travelers

Different travel styles and traveler profiles require tailored insurance approaches. Understanding your traveler category helps choose the right travel insurance meeting your specific needs.

Solo Travelers and Backpackers

Solo travelers face unique vulnerabilities when traveling alone, making comprehensive coverage particularly important. Medical emergencies become more challenging without companions to assist, and evacuation needs may arise more frequently.

Backpackers traveling long-term need flexible policies allowing coverage extensions and modifications during trips. World Nomads and similar providers specialize in backpacker coverage, offering month-by-month renewable policies and coverage for adventure activities.

Budget travelers balancing comprehensive coverage against limited budgets might consider higher deductibles to reduce premiums while maintaining essential protections for catastrophic situations.

Family Travelers

Family policies typically cover two adults and dependent children under a single policy, providing better value than individual policies for each family member. Child coverage often includes minimal or no additional premium up to certain ages.

Families should prioritize trip cancellation coverage, as illness affecting any family member typically cancels entire family trips. Medical coverage limits should be generous, as treating multiple family members simultaneously could quickly exhaust coverage.

Consider additional coverage for separated baggage, as families traveling with children need essential items for multiple people if luggage is delayed.

Senior Travelers

Travelers over sixty-five face higher insurance costs and more limited policy options due to increased medical risks. Some insurers impose age limits or require medical screening for older applicants.

Seniors should prioritize maximum medical coverage limits and comprehensive emergency evacuation coverage. Pre-existing condition coverage becomes particularly important, as most seniors have health conditions requiring ongoing treatment.

Annual multi-trip policies may provide better value for active retired travelers taking multiple trips yearly, though these policies typically limit individual trip durations to thirty or sixty days.

Adventure and Sports Travelers

Standard travel insurance excludes most adventure activities, requiring specialized coverage for skiing, scuba diving, trekking, or extreme sports. Verify exactly which activities your policy covers, as definitions vary between insurers.

Adventure coverage typically costs ten to twenty-five percent more than standard policies but provides essential protection for medical treatment and evacuation following adventure activity injuries. Some providers offer activity-specific riders, allowing you to add coverage only for activities you plan to pursue.

Professional or competitive participation in sports typically isn’t covered even under adventure policies, which focus on recreational participation.

Business Travelers

Business travelers should verify whether their employer’s insurance provides international coverage for work-related travel. Many corporate policies offer excellent medical coverage but limited trip cancellation protection for personal reasons.

Business equipment coverage protects laptops, tablets, and other work devices beyond standard baggage limits. Policies offering coverage for business documents and lost business opportunities may benefit frequent business travelers.

Consider annual multi-trip policies if you travel internationally for business regularly, ensuring continuous coverage across multiple trips.

6. Medical Coverage Requirements and Recommendations

Medical coverage forms the foundation of travel insurance. Understanding medical coverage details helps you choose the right travel insurance providing adequate protection for health emergencies abroad.

Determining Appropriate Medical Coverage Limits

Minimum recommended medical coverage typically starts at fifty thousand dollars for short trips to countries with reasonable healthcare costs. Increase this to at least one hundred thousand dollars for trips to expensive medical destinations or longer journeys.

Travelers over sixty, those with health conditions, or anyone visiting remote areas should consider two hundred fifty thousand to five hundred thousand dollar limits. Some insurers offer unlimited medical coverage, eliminating concerns about exceeding policy limits during serious medical emergencies.

Research your destination’s typical medical costs. A hospital stay in Thailand might cost a few thousand dollars, while identical treatment in the United States could exceed one hundred thousand dollars. Match coverage limits to destination-specific risks.

Emergency Medical Evacuation Essentials

Emergency evacuation coverage should be unlimited or carry very high limits, as evacuation costs vary enormously based on location and transportation requirements. Helicopter evacuations from remote mountains, air ambulances from islands, or medical flights across continents easily cost fifty thousand to two hundred thousand dollars.

Verify whether evacuation coverage includes repatriation to your home country for treatment or only transportation to the nearest adequate medical facility. Best policies offer both options, allowing medical professionals to determine appropriate destinations.

Some policies include coverage for family members to travel to your location or accompany you home, valuable during serious medical emergencies requiring extended care.

Pre-Existing Condition Coverage

Travelers with pre-existing medical conditions face complex insurance situations. Most standard policies exclude these conditions entirely, leaving you unprotected for your highest-risk health issues.

Pre-existing condition waivers, available through comprehensive policies purchased within specified timeframes after initial trip deposits, provide coverage for stable pre-existing conditions. Requirements typically include purchasing insurance within fourteen to twenty-one days of initial payment and covering the entire trip cost.

Some insurers define pre-existing conditions more favorably, using shorter lookback periods or more lenient stability requirements. Travelers with chronic conditions should carefully compare these definitions across providers.

Dental and Vision Coverage

Dental coverage typically only covers emergency treatment for sudden, unexpected dental injuries. Regular dental work or pre-existing dental conditions aren’t covered. Vision coverage similarly focuses on emergency treatment for eye injuries rather than routine vision care.

Travelers experiencing dental or vision problems abroad should verify emergency coverage availability before requiring expensive treatments far from home.

7. Understanding Claims Processes and Documentation

Even the best travel insurance provides no value if you cannot successfully file claims when needed. Understanding claims processes before traveling helps ensure smooth reimbursement when emergencies occur.

Essential Documentation to Maintain

Keep all receipts, invoices, and documentation related to any situation where you might file claims. Medical treatment requires itemized bills, diagnostic reports, prescription receipts, and doctor’s notes explaining treatment necessity.

Trip cancellation claims need documentation proving covered reasons, including death certificates, doctor’s letters confirming medical inability to travel, jury summons, or termination letters from employers.

Lost or stolen items require police reports filed promptly after incidents occur. Photograph expensive items before traveling and maintain receipts proving purchase prices for valuable electronics, jewelry, or other high-value belongings.

Filing Claims Effectively

Contact your insurance provider as soon as situations arise that might lead to claims. Many policies require pre-approval for medical treatments or have strict reporting deadlines. Emergency assistance lines operate twenty-four hours daily, helping you navigate claims processes from anywhere in the world.

Document everything thoroughly, including dates, times, names of people you interact with, and details of incidents. The more complete your documentation, the smoother your claims process becomes.

Submit claims as quickly as possible after returning home or resolving situations. Most policies require claim submission within specific timeframes, often ninety days to one year from incident dates.

Common Claim Denials and How to Avoid Them

Claims are frequently denied for failing to meet reporting deadlines, inadequate documentation, or situations falling under policy exclusions. Carefully read policy requirements and follow procedures exactly as specified.

Incomplete claim forms or missing supporting documentation delay processing and may result in denials. Submit complete packages including all requested documentation initially rather than piecemeal submissions.

Pre-existing condition claims without proper waivers are automatically denied. Understand your policy’s pre-existing condition definitions and ensure you’ve met waiver requirements if applicable.

Appealing Denied Claims

If your claim is denied, request detailed explanations citing specific policy language supporting the denial. Review your policy documents carefully to determine whether the denial is justified.

Many denied claims result from misunderstandings or documentation issues that can be resolved through additional information or clarification. Persistence often leads to successful appeals when claims are legitimately covered.

Consider contacting insurance regulators in your jurisdiction if you believe an insurer has improperly denied a valid claim. Regulators can investigate complaints and pressure insurers to honor legitimate obligations.

8. Budget Considerations and Cost-Saving Strategies

Travel insurance represents important financial protection, but costs can add significantly to overall trip expenses. Smart strategies help you choose the right travel insurance that balances comprehensive coverage with budget constraints.

Factors Affecting Insurance Costs

Your age represents the single biggest factor influencing travel insurance premiums. Travelers over seventy pay two to three times more than younger travelers for identical coverage due to higher medical risks.

Trip cost directly affects cancellation coverage premiums, as these are typically calculated as percentages of total insured trip costs. Longer trips cost more to insure than shorter journeys due to increased exposure periods.

Destination affects pricing, with travel to countries having expensive medical systems or higher risk profiles commanding higher premiums. Coverage levels, deductible amounts, and optional riders all influence final costs.

Money-Saving Insurance Strategies

Purchase annual multi-trip policies if you take multiple international trips yearly. These policies often cost less than two single-trip policies while covering unlimited trips up to maximum per-trip durations.

Increase deductibles to reduce premiums significantly if you can afford higher out-of-pocket costs before insurance coverage begins. This strategy works well for travelers primarily concerned about catastrophic losses rather than minor expenses.

Consider medical-only policies if trip costs are minimal or bookings are refundable. These focused policies cost less than comprehensive plans while providing essential health and evacuation coverage.

Buy insurance directly from insurers rather than through travel agents or tour operators, who typically mark up policies significantly. Direct purchase ensures you understand coverage details and often provides better prices.

When Insurance May Not Be Necessary

Short domestic trips where your regular health insurance provides coverage may not require additional travel insurance. Weekend getaways with minimal advance bookings and flexible arrangements carry lower financial risks.

Trips where all expenses are refundable don’t require trip cancellation coverage. If you can cancel flights, hotels, and activities without penalties, that coverage becomes unnecessary.

Travelers with excellent credit card travel benefits may find their existing coverage adequate for short international trips, though carefully verify coverage limits and requirements.

Understanding True Cost of Going Uninsured

While travel insurance adds to trip costs, the expense pales compared to potential losses without coverage. A single medical emergency requiring hospitalization and evacuation easily costs more than dozens of vacation insurance policies.

Consider insurance an essential travel expense like flights and accommodations rather than optional expense to potentially eliminate. The financial and emotional costs of uninsured emergencies far exceed premium payments.

9. Reading and Understanding Policy Documents

Insurance policies are legal contracts with specific terms, conditions, and exclusions. Thoroughly understanding these documents before purchasing helps you choose the right travel insurance and avoid surprises when filing claims.

Certificate of Insurance Essentials

The certificate of insurance contains your policy’s complete terms, while marketing materials provide only summaries. Request and read the actual certificate before purchasing, ensuring you understand exactly what is and isn’t covered.

Pay particular attention to definitions sections, as policies use specific meanings for terms like “pre-existing condition,” “injury,” “sickness,” and “covered reason” that may differ from common usage.

Coverage amount sections specify maximum benefits available for each coverage type and overall policy limits. Verify these amounts adequately protect your potential losses.

Exclusions Sections

Exclusions sections, often the longest portions of policies, list situations, conditions, and circumstances not covered. Read these carefully, as they significantly limit what policies actually cover despite expansive coverage descriptions elsewhere.

Common exclusions include pre-existing conditions, high-risk activities, mental health issues, substance abuse, intentional self-harm, illegal activities, and travel against government warnings. Understanding exclusions prevents purchasing inadequate coverage.

Conditions and Requirements

Policy conditions specify your obligations for maintaining coverage eligibility. These include reporting deadlines, documentation requirements, cooperation with investigations, and requirements to mitigate losses.

Failure to meet policy conditions can void coverage even for otherwise covered situations. Understand your responsibilities before purchasing and maintain compliance throughout your trip.

Asking Questions Before Purchasing

Contact insurers directly with questions about policy interpretation, coverage applicability to specific situations, or unclear terminology. Document responses, including representative names and dates, for reference if disputes arise later.

Independent insurance agents can explain policy details and recommend appropriate coverage based on your specific situation. Their expertise helps navigate complex insurance terminology and identify policies meeting your needs.

10. Travel Insurance for Specific Destinations and Situations

Certain destinations and travel situations create unique insurance requirements beyond standard coverage considerations. Recognizing these special circumstances helps you choose the right travel insurance providing adequate protection for your specific journey.

High-Risk Destinations

Travel to regions experiencing political instability, civil unrest, or conflict requires specialized coverage explicitly including these situations. Standard policies often exclude coverage when traveling against government advisories.

Insurers offering high-risk destination coverage typically cost more but provide essential protection for journalists, aid workers, or others with legitimate reasons for traveling to dangerous areas. Some policies include kidnap and ransom coverage, political evacuation, and coverage for situations standard policies exclude.

Cruise Travel Insurance

Cruise-specific insurance addresses unique cruise situations including trip interruption while at sea, missed port expenses when shore excursions are cancelled, and medical evacuation from ships to shore facilities.

Standard travel insurance often doesn’t adequately cover cruise-specific scenarios. Consider purchasing cruise-focused policies or ensuring your chosen policy explicitly covers cruise travel particulars.

Remote and Adventure Destinations

Travel to remote areas far from quality medical facilities makes emergency evacuation coverage absolutely essential. Standard evacuation coverage may not adequately address costs of evacuations from Antarctica, remote Pacific islands, or deep wilderness areas.

Verify your policy covers search and rescue expenses, which standard policies often exclude or severely limit. These costs can reach tens of thousands of dollars for mountain rescues or ocean evacuations.

Pandemic and Epidemic Coverage

Recent global events highlighted gaps in traditional travel insurance regarding pandemics, epidemics, and related government actions. Many policies explicitly exclude pandemic-related claims or severely limit coverage.

Newer policies increasingly offer pandemic coverage, though definitions and limitations vary dramatically. Look for policies specifically stating they cover COVID-19 and other pandemic-related situations for both medical treatment and trip cancellation.

Understand that pandemic coverage often excludes situations where you travel against government advisories or to destinations with known outbreaks. Coverage typically applies to unexpected pandemic developments rather than traveling during existing pandemic conditions.

Working Holiday and Study Abroad

Students and working holiday participants need long-term coverage spanning months or years. Student-specific policies address academic-related issues including tuition reimbursement if you must withdraw due to medical reasons.

Working holiday insurance should confirm coverage remains valid while you engage in employment abroad, as some policies exclude injuries or illnesses related to work activities.

Conclusion: Making Your Final Insurance Decision

Choosing travel insurance requires balancing comprehensive protection against budget realities while ensuring coverage matches your specific travel risks. The process involves understanding fundamental coverage types, honestly assessing your personal needs, carefully comparing provider options, and thoroughly reading policy documents before purchasing.

Start your insurance selection process by identifying your primary concerns. Medical emergencies top most travelers’ worry lists, making generous medical coverage and emergency evacuation protection essential for virtually everyone. Trip cancellation coverage becomes vital when you’ve invested significant money in non-refundable bookings. Baggage coverage provides peace of mind for travelers carrying valuable belongings.

Compare multiple policies using comparison tools that allow side-by-side evaluation of coverage limits, exclusions, and costs. Don’t automatically choose the cheapest option, as inadequate coverage costing a few dollars less provides false economy when you actually need protection. Conversely, avoid overpaying for coverage you don’t need, like expensive cancel for any reason riders when your trip circumstances are stable.

Read complete policy documents rather than marketing summaries, paying particular attention to exclusions, conditions, and claim procedures. Contact insurers with questions before purchasing, ensuring you understand exactly what your policy covers and requires.

Remember that the best travel insurance is coverage you never need to use. However, having appropriate protection allows you to travel confidently, knowing that unexpected medical emergencies, trip disruptions, or lost belongings won’t devastate your finances or ruin your journey.

Purchase your insurance shortly after booking your trip to maximize protection periods and potentially qualify for pre-existing condition waivers. Keep policy documents, emergency contact numbers, and claim procedures easily accessible during your travels.

Learning to choose the right travel insurance transforms from overwhelming task to straightforward process when you understand coverage fundamentals, recognize your specific needs, and carefully evaluate available options. Your perfect policy exists among the many options available, providing precisely the coverage you need at prices fitting your budget. With proper protection in place, you can focus on what matters most, experiencing the incredible adventures and memories that international travel creates, confident that you’re prepared for whatever unexpected situations might arise. Safe travels, and may your travel insurance remain the best investment you never need to use.

Also read this:

Best Beach Destinations in the World for Crystal-Clear Water, Clean Sand, and Affordable Resorts