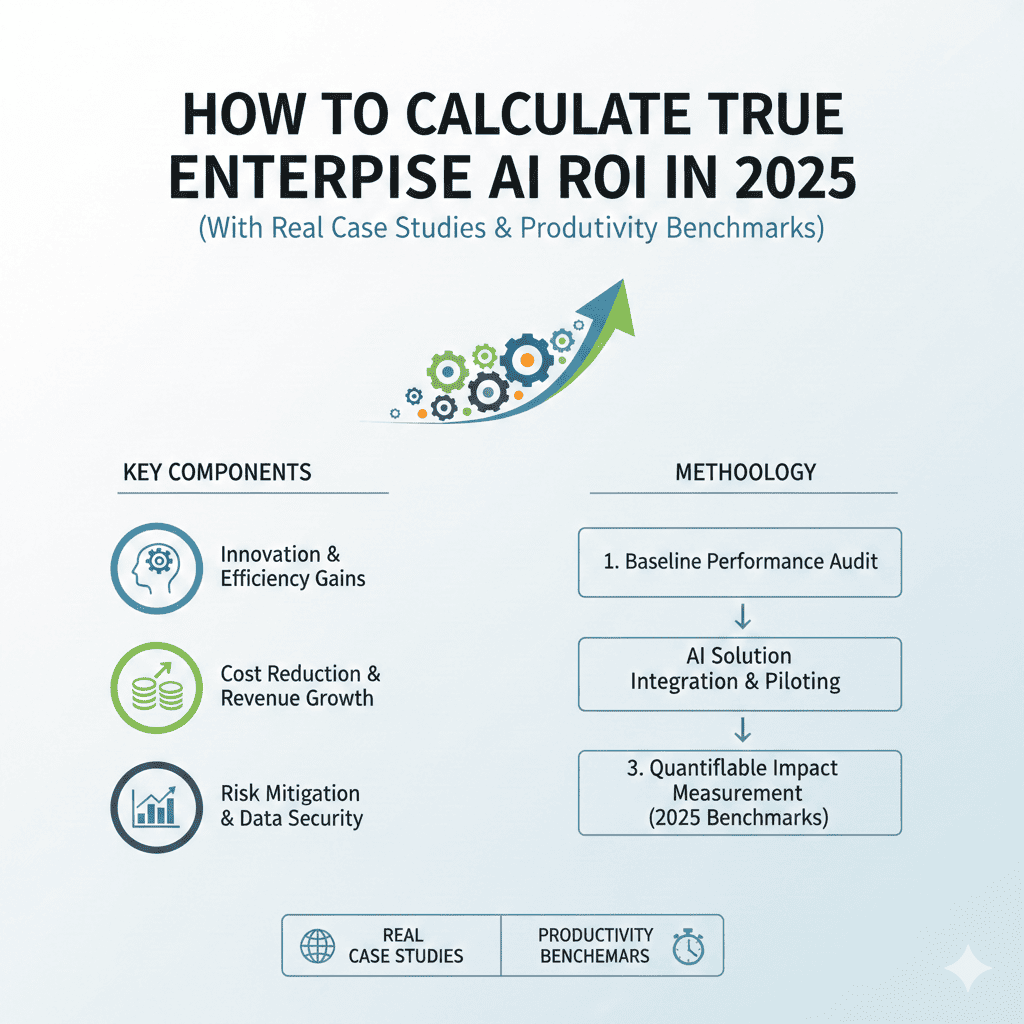

Enterprise AI adoption has reached a critical inflection point. Companies worldwide are investing billions in artificial intelligence initiatives, yet many struggle to demonstrate tangible returns. The challenge isn’t whether AI delivers value, but rather how to accurately measure and calculate true enterprise AI ROI in ways that satisfy stakeholders and guide strategic decisions.

The complexity of AI investments extends far beyond simple cost-benefit analysis. Traditional ROI calculations fall short when applied to transformative technologies that reshape workflows, enhance decision-making, and unlock entirely new capabilities. Understanding how to calculate true enterprise AI ROI requires a comprehensive framework that captures both immediate gains and long-term strategic advantages.

This guide provides enterprise leaders, financial analysts, and technology executives with proven methodologies to calculate true enterprise AI ROI using real-world case studies and industry-validated productivity benchmarks. Whether you’re justifying an initial AI investment or evaluating existing implementations, these frameworks will help you measure what truly matters and communicate value effectively to board members, investors, and operational teams.

1. Understanding the Complete Cost Structure of Enterprise AI

Before you can calculate true enterprise AI ROI, you must establish a comprehensive understanding of all costs involved. Many organizations underestimate total expenses by focusing exclusively on software licensing while overlooking substantial hidden costs that emerge during implementation and operation.

Direct Technology Costs

The most visible expenses in any AI initiative include licensing fees, API usage charges, and infrastructure investments that form the foundation of your AI ecosystem.

Software Licensing and Subscription Fees

- Enterprise AI platform licenses ranging from fifty thousand to five hundred thousand dollars annually

- Per-user seat charges for conversational AI and copilot tools

- API consumption costs based on token usage or transaction volumes

- Premium feature access for advanced capabilities like custom model training

- Multi-year commitment discounts that can reduce costs by fifteen to thirty percent

Cloud Infrastructure and Computing Resources

- Monthly cloud computing expenses between ten thousand and one hundred thousand dollars

- GPU and specialized AI accelerator costs for training and inference

- Data storage fees for training datasets and model artifacts

- Network bandwidth charges for data transfer and API calls

- Auto-scaling resources that fluctuate with demand patterns

Hardware and On-Premise Infrastructure

- GPU cluster investments from two hundred thousand to several million dollars

- Specialized AI accelerators and tensor processing units

- High-performance storage systems for large-scale data processing

- Networking infrastructure to support distributed computing

- Backup and disaster recovery systems for business continuity

Implementation and Integration Expenses

Professional services for AI implementation frequently exceed initial technology costs, representing a substantial portion of total investment when you calculate true enterprise AI ROI.

Consulting and Professional Services

- System integration consulting at rates between two hundred and five hundred dollars per hour

- Enterprise architecture planning and design services

- Change management consulting to facilitate organizational adoption

- Security and compliance auditing for regulated industries

- Project management oversight for complex multi-phase implementations

Custom Development and Model Training

- Data science team costs for model development and experimentation

- Engineering resources for API integration and workflow automation

- Custom user interface development for employee-facing applications

- Model fine-tuning on proprietary datasets for domain-specific performance

- Testing and quality assurance across diverse use cases and edge conditions

Data Preparation and Engineering

- Data cleaning and normalization to ensure quality inputs

- Dataset labeling and annotation for supervised learning approaches

- Data pipeline development for continuous model feeding

- Legacy system data extraction and transformation

- Governance frameworks for data quality and lineage tracking

Ongoing Operational Costs

Maintaining AI systems requires dedicated resources that continue long after initial deployment, making these expenses critical when organizations calculate true enterprise AI ROI.

Personnel and Team Costs

- AI engineers and machine learning specialists with salaries from one hundred twenty thousand to two hundred fifty thousand dollars

- Data scientists for model optimization and performance monitoring

- MLOps specialists managing deployment pipelines and infrastructure

- Business analysts translating requirements into AI capabilities

- Support staff handling user questions and troubleshooting issues

Maintenance and Continuous Improvement

- Model retraining to adapt to changing data patterns and business conditions

- Performance monitoring and drift detection systems

- A/B testing infrastructure for comparing model versions

- Bug fixes and security patches for production systems

- Feature development based on user feedback and evolving requirements

Training and Change Management

- Initial employee training programs across all affected departments

- Ongoing education for new features and best practices

- Change champion programs to drive adoption

- Documentation creation and maintenance

- Feedback collection and user experience research

2. Identifying and Quantifying Direct Value Drivers

To accurately calculate true enterprise AI ROI, organizations must systematically identify and measure the tangible benefits AI delivers across different functional areas and business processes.

Labor Productivity Gains

Automation and augmentation of human work represents the most immediate and measurable return on AI investments.

Routine Task Automation

- Document processing time reduced by fifty to eighty percent

- Data entry elimination saving ten to thirty hours per employee weekly

- Report generation automated from hours to minutes

- Email triage and response suggestion cutting response time by forty to sixty percent

- Meeting transcription and summarization reclaiming five to ten hours weekly per knowledge worker

Decision-Making Acceleration

- Real-time insights reducing decision cycles by thirty to sixty percent

- Predictive analytics enabling proactive rather than reactive management

- Risk assessment automation for faster approval processes

- Scenario modeling that previously required days completed in minutes

- Executive dashboard automation providing instant performance visibility

Knowledge Democratization

- Junior employees performing tasks previously requiring senior expertise

- Self-service analytics reducing bottlenecks on data teams

- Institutional knowledge capture preventing loss from employee turnover

- Best practice dissemination across distributed teams

- Consistent quality regardless of individual employee experience level

Revenue Enhancement Opportunities

AI-driven revenue growth provides compelling evidence of value when organizations calculate true enterprise AI ROI.

Customer Experience Transformation

- Personalization driving conversion rate improvements of fifteen to forty percent

- Recommendation engines increasing average order value by twenty to thirty-five percent

- Chatbot resolution rates exceeding seventy percent for common inquiries

- Customer satisfaction scores improving by twenty to thirty-five points

- Reduced churn rates through predictive intervention saving high-value customers

Market Expansion Capabilities

- New market entry enabled by AI-powered localization and customization

- Product innovation creating entirely new revenue streams

- Dynamic pricing optimization increasing margins by five to fifteen percent

- Micro-segmentation allowing targeted offerings for niche markets

- Scalable customer acquisition through AI-optimized marketing

Sales Force Effectiveness

- Lead scoring accuracy improvements of thirty to fifty percent

- Sales cycle reduction through better qualification and prioritization

- Win rate increases of twenty to forty percent with AI-powered insights

- Account expansion opportunities identified proactively

- Sales productivity gains of twenty-five to fifty percent per representative

Cost Reduction and Avoidance

Operational efficiency improvements deliver immediate bottom-line impact that strengthens the case when you calculate true enterprise AI ROI.

Process Optimization

- Customer service center costs reduced by twenty to forty percent

- Supply chain optimization lowering inventory costs by fifteen to thirty percent

- Quality control automation reducing inspection costs by forty to sixty percent

- Procurement optimization identifying savings opportunities worth five to twelve percent of spend

- Facilities management efficiency improvements of twenty to thirty-five percent

Error Prevention and Quality Enhancement

- Manufacturing defect rates reduced by forty to seventy percent

- Compliance violation prevention avoiding regulatory fines

- Fraud detection accuracy improvements preventing losses worth millions

- Warranty claim reductions through proactive quality management

- Customer complaint decreases improving brand reputation and retention

Resource Utilization Optimization

- Inventory holding costs reduced by twenty to thirty-five percent

- Workforce scheduling efficiency gains of fifteen to twenty-five percent

- Energy consumption optimization lowering utility costs by ten to twenty percent

- Asset utilization improvements extending equipment life by fifteen to thirty percent

- Marketing spend optimization through better channel attribution and allocation

3. Measuring Intangible Benefits and Strategic Value

A complete framework to calculate true enterprise AI ROI must account for benefits that resist simple financial quantification but deliver substantial long-term value.

Competitive Positioning and Market Advantages

Strategic benefits often represent the most significant long-term value from AI investments.

Market Responsiveness

- Trend identification weeks or months before competitors

- Customer preference understanding enabling faster adaptation

- Pricing agility responding to market conditions in real-time

- Product portfolio optimization based on predictive demand signals

- First-mover advantages in emerging market segments worth ten to thirty percent premiums

Innovation Velocity

- Product development cycle time reductions of thirty to fifty percent

- Increased experimentation capacity enabling more innovation attempts

- Failure identification earlier in development reducing waste

- Design optimization through AI-powered simulation and testing

- Patent generation acceleration in competitive technology spaces

Brand Differentiation

- Premium positioning through superior AI-powered experiences

- Customer loyalty improvements from personalized interactions

- Market perception as an innovation leader

- Talent attraction advantages in competitive hiring markets

- Partnership opportunities with other innovation-focused organizations

Risk Mitigation and Resilience

AI capabilities that reduce organizational risk create substantial value through crisis prevention and improved adaptability.

Operational Risk Reduction

- Anomaly detection preventing system failures before they impact customers

- Cybersecurity threat identification and response acceleration

- Supply chain disruption prediction and mitigation

- Regulatory compliance monitoring reducing audit findings

- Business continuity planning based on predictive risk assessment

Financial Risk Management

- Credit risk assessment accuracy improvements of twenty to forty percent

- Fraud detection reducing losses by thirty to sixty percent

- Market risk exposure optimization in volatile conditions

- Cash flow forecasting accuracy enabling better capital allocation

- Scenario planning for economic uncertainty

Reputational Protection

- Social media sentiment monitoring for early crisis detection

- Quality issue identification before widespread customer impact

- Customer complaint pattern recognition enabling proactive resolution

- Brand perception tracking across channels and demographics

- Competitive intelligence for strategic positioning

Employee Experience and Retention

Workforce benefits from AI contribute to organizational success through improved retention, satisfaction, and performance.

Job Satisfaction Enhancement

- Elimination of tedious tasks improving employee engagement

- Skill development opportunities through AI collaboration

- Work-life balance improvements from greater efficiency

- Career advancement enabled by productivity multipliers

- Purpose-driven work replacing repetitive manual processes

Talent Attraction and Retention

- Employer brand strengthening through technology leadership

- Reduced turnover saving twenty to forty percent of annual salary per retained employee

- Training cost avoidance from lower new hire requirements

- Institutional knowledge preservation through AI-captured expertise

- Competitive advantages in hiring markets for top talent

Collaboration and Communication

- Cross-functional visibility improving coordination

- Language barriers reduced through AI-powered translation

- Meeting efficiency gains from AI-generated summaries and action items

- Knowledge sharing acceleration across distributed teams

- Decision transparency through AI-documented reasoning

4. Real Case Study: Global Manufacturing Company

Examining how successful organizations calculate true enterprise AI ROI provides practical insights for your own measurement frameworks.

Company Profile and AI Initiative

A Fortune 500 manufacturing company with fifteen thousand employees and three billion dollars in annual revenue implemented enterprise AI across quality control, supply chain optimization, and customer service operations. The three-year initiative began with a two million dollar investment in year one, scaling to five million annually in years two and three.

Detailed Cost Breakdown

Year One Implementation Costs

- AI platform licensing and infrastructure: six hundred thousand dollars

- Consulting and integration services: eight hundred thousand dollars

- Data preparation and engineering: four hundred thousand dollars

- Employee training and change management: two hundred thousand dollars

- Total year one investment: two million dollars

Ongoing Annual Costs Years Two and Three

- Platform licensing and cloud infrastructure: one million dollars

- Dedicated AI operations team: two million dollars

- Continuous improvement and model maintenance: one million dollars

- Expanded training and adoption programs: five hundred thousand dollars

- Total annual ongoing investment: four point five million dollars

Quantified Benefits and Returns

Quality Control Improvements

- Defect detection rate improved from seventy-five to ninety-four percent

- Manufacturing rework costs reduced by three point two million dollars annually

- Warranty claims decreased by forty-eight percent saving two point eight million dollars annually

- Customer satisfaction scores improved by twenty-seven points

- Total annual quality-related value: six million dollars

Supply Chain Optimization

- Inventory holding costs reduced by twenty-eight percent saving four point five million dollars annually

- Stockout situations decreased by sixty-two percent improving revenue by three point one million dollars

- Supplier quality issues identified proactively preventing two point four million in disruptions

- Logistics optimization reducing transportation costs by one point eight million dollars annually

- Total annual supply chain value: eleven point eight million dollars

Customer Service Transformation

- Chatbot resolution rate of seventy-three percent for tier-one inquiries

- Customer service team size maintained despite forty percent volume growth

- Headcount avoidance value of approximately two point five million dollars annually

- Average handle time reduced by thirty-four percent improving capacity

- Customer satisfaction improved by thirty-one points driving retention worth three point seven million dollars

- Total annual customer service value: six point two million dollars

Three-Year ROI Calculation

When this organization chose to calculate true enterprise AI ROI, they used a comprehensive framework capturing all costs and benefits:

Total Investment Over Three Years

- Year one: two million dollars

- Year two: four point five million dollars

- Year three: four point five million dollars

- Total three-year investment: eleven million dollars

Total Quantified Benefits Over Three Years

- Year one benefits (six months of full operation): twelve million dollars

- Year two benefits (full year at scale): twenty-four million dollars

- Year three benefits (full year with optimizations): twenty-six million dollars

- Total three-year benefits: sixty-two million dollars

ROI Metrics

- Net benefit over three years: fifty-one million dollars

- Return on investment: four hundred sixty-four percent

- Payback period: six months from full deployment

- Annual return rate: one hundred fifty-five percent

Strategic Benefits Beyond Direct ROI

The company identified additional strategic advantages that strengthened their decision to invest despite challenges in precise quantification:

- Market share gains in quality-sensitive segments worth an estimated five to eight percent of segment revenue

- Talent retention improvements with voluntary turnover decreasing by twelve percent

- Innovation cycle acceleration enabling three new product launches eighteen months ahead of original timeline

- Competitive positioning as industry technology leader opening partnership opportunities

- Risk mitigation preventing an estimated fifteen million dollars in potential supply chain disruptions

5. Real Case Study: Financial Services Enterprise

This case study demonstrates how financial institutions calculate true enterprise AI ROI across risk management, customer acquisition, and operational efficiency.

Company Profile and Implementation Scope

A mid-sized financial services company with eight thousand employees and twelve billion dollars in assets under management deployed AI for fraud detection, customer service, investment analysis, and risk assessment. The initiative spanned two years with strategic focus on regulatory compliance and customer experience.

Investment Structure

Initial Deployment Costs

- Enterprise AI platform and data infrastructure: one point eight million dollars

- Integration with existing systems: one point two million dollars

- Data science team hiring and training: nine hundred thousand dollars

- Compliance and security auditing: four hundred thousand dollars

- Total initial investment: four point three million dollars

Annual Operating Costs

- Platform licensing and infrastructure: eight hundred thousand dollars

- AI operations team: one point six million dollars

- Model monitoring and retraining: six hundred thousand dollars

- Ongoing compliance and auditing: three hundred thousand dollars

- Total annual operating cost: three point three million dollars

Measured Impact and Value Creation

Fraud Detection Enhancement

- Fraud detection accuracy improved from seventy-eight to ninety-six percent

- False positive rate reduced by sixty-seven percent saving investigation resources

- Prevented fraud losses: eight point four million dollars annually

- Investigation efficiency gains: one point two million dollars annually

- Customer friction reduction improving retention: estimated two point one million dollars annually

- Total annual fraud prevention value: eleven point seven million dollars

Customer Acquisition and Retention

- Application processing time reduced from five days to four hours

- Conversion rate improvement of thirty-eight percent on approved applications

- New customer acquisition value: six point eight million dollars annually

- Personalized service recommendations increasing product adoption by forty-two percent

- Cross-sell success rate improvement generating four point three million dollars annually

- Customer lifetime value increase: estimated seven point nine million dollars annually

- Total annual customer-related value: nineteen million dollars

Operational Efficiency Gains

- Middle office processing automation reducing headcount needs by thirty-two percent

- Cost avoidance from slower headcount growth: three point five million dollars annually

- Compliance reporting automation saving four thousand hours quarterly

- Regulatory compliance efficiency value: one point eight million dollars annually

- Investment research augmentation improving analyst productivity by forty-eight percent

- Research efficiency value: two point two million dollars annually

- Total annual operational value: seven point five million dollars

ROI Analysis Over Two Years

The financial services firm used sophisticated methods to calculate true enterprise AI ROI including risk-adjusted returns:

Total Two-Year Investment

- Initial deployment: four point three million dollars

- Year one operations: three point three million dollars

- Year two operations: three point three million dollars

- Total investment: ten point nine million dollars

Total Two-Year Returns

- Year one benefits (partial year): twenty-two million dollars

- Year two benefits (full scale): thirty-eight million dollars

- Total two-year benefits: sixty million dollars

Financial Metrics

- Net benefit: forty-nine point one million dollars

- ROI: four hundred fifty percent

- Payback period: four months after full deployment

- Risk-adjusted return: three hundred eighty-two percent accounting for implementation uncertainty

Regulatory and Compliance Benefits

Beyond direct financial returns, the organization realized substantial value through improved regulatory positioning:

- Audit findings reduced by seventy-eight percent through automated compliance monitoring

- Regulatory reporting accuracy improvements preventing potential fines estimated at two to five million dollars

- Suspicious activity detection improvements reducing regulatory risk exposure

- Customer protection enhancements through better fraud prevention and fair lending practices

- Examiner feedback improvements strengthening regulatory relationships

6. Productivity Benchmarks Across Industries

Understanding industry-specific benchmarks helps organizations calculate true enterprise AI ROI with realistic expectations and appropriate peer comparisons.

Technology and Software Development

AI augmentation in software development shows some of the highest productivity gains across industries.

Code Generation and Development

- Developer productivity improvements of thirty to fifty-five percent with AI coding assistants

- Bug detection rates improving by forty to sixty-five percent through automated code review

- Documentation generation reducing technical writing time by sixty to eighty percent

- Test case creation automation saving twenty to forty hours per sprint

- Code refactoring suggestions improving maintainability and reducing technical debt

Product Management and Design

- User research analysis automation reducing synthesis time by fifty to seventy percent

- A/B test analysis acceleration from days to hours

- Feature prioritization optimization through AI-powered impact modeling

- Design system maintenance automation

- Customer feedback analysis processing ten times more data with equal resources

Healthcare and Life Sciences

Medical AI applications deliver substantial productivity and quality improvements while navigating strict regulatory requirements.

Clinical Operations

- Medical imaging analysis time reduced by forty to sixty percent with maintained or improved accuracy

- Clinical documentation time decreased by thirty to fifty percent through ambient AI scribes

- Prior authorization processing accelerated from days to hours

- Patient risk stratification enabling proactive intervention for high-risk populations

- Treatment protocol adherence monitoring improving outcomes by fifteen to thirty percent

Research and Drug Development

- Compound screening productivity improvements of forty to seventy percent

- Clinical trial patient matching reducing recruitment time by thirty to fifty percent

- Literature review automation enabling researchers to process five times more publications

- Adverse event detection in clinical trials improving safety monitoring

- Regulatory submission document preparation time reduced by forty percent

Retail and E-Commerce

Customer-facing AI applications in retail demonstrate clear connections between technology investment and revenue growth.

Customer Experience

- Personalization engine improvements lifting conversion rates by twenty to forty-five percent

- Virtual assistant resolution rates of sixty to eighty percent for common inquiries

- Size and fit recommendation accuracy reducing returns by twenty to thirty-five percent

- Dynamic search optimization improving product discovery

- Abandoned cart recovery campaigns with AI-optimized timing and messaging

Operations and Supply Chain

- Demand forecasting accuracy improvements of twenty-five to forty percent

- Inventory optimization reducing carrying costs by fifteen to thirty percent

- Price optimization increasing margins by five to twelve percent

- Store labor scheduling efficiency gains of twenty to thirty-five percent

- Supplier performance prediction enabling proactive risk management

Manufacturing and Industrial

Process industries realize substantial value through AI-driven optimization and predictive capabilities.

Production Optimization

- Predictive maintenance reducing unplanned downtime by thirty to sixty percent

- Quality control defect detection rates improving by forty to seventy percent

- Production scheduling optimization increasing throughput by ten to twenty-five percent

- Energy consumption reduction of fifteen to thirty percent through AI optimization

- Yield improvements in complex manufacturing processes worth millions annually

Supply Chain and Logistics

- Route optimization reducing transportation costs by twelve to twenty-five percent

- Warehouse automation improving picking efficiency by thirty to fifty percent

- Demand sensing accuracy improvements of twenty to forty percent

- Supplier risk assessment preventing disruptions worth significant multiples of AI investment

- Inventory positioning optimization reducing working capital requirements

7. Building Your ROI Calculation Framework

Organizations seeking to calculate true enterprise AI ROI need structured frameworks that capture complexity while remaining practical for decision-making.

Establishing Baseline Metrics

Accurate ROI calculation requires clear understanding of pre-AI performance across all affected areas.

Operational Baselines

- Current process cycle times for all workflows AI will impact

- Error rates and quality metrics before AI intervention

- Labor hours allocated to tasks targeted for automation or augmentation

- Customer satisfaction and experience scores across touchpoints

- Resource utilization rates for equipment, facilities, and working capital

Financial Baselines

- Fully-loaded cost per transaction or process execution

- Revenue per employee or per process for revenue-generating activities

- Cost of quality including rework, warranty, and customer remediation

- Customer acquisition costs and lifetime value metrics

- Working capital requirements and cash conversion cycles

Strategic Baselines

- Market share in relevant segments and overall

- Innovation velocity measured by time-to-market or patent generation

- Employee satisfaction and turnover rates

- Brand perception and Net Promoter Scores

- Competitive positioning on key dimensions

Projection Methodology

Conservative, realistic projections strengthen credibility when you calculate true enterprise AI ROI for stakeholder approval.

Phased Benefit Realization

- Pilot phase with limited benefits capturing ten to twenty-five percent of projected value

- Initial deployment achieving forty to sixty percent of steady-state benefits

- Optimization phase reaching seventy to ninety percent of full potential

- Mature operation realizing one hundred percent or more of original projections

- Time horizons of six to eighteen months between phases depending on scope

Risk-Adjusted Projections

- Probability-weighted scenarios for optimistic, realistic, and pessimistic outcomes

- Implementation risk factors including technical complexity and organizational change challenges

- External risk considerations including market conditions and competitive responses

- Sensitivity analysis showing ROI across different assumption scenarios

- Contingency planning for underperformance requiring course corrections

Incremental Analysis

- Benefits directly attributable to AI versus improvements from concurrent initiatives

- Counterfactual analysis estimating what would have occurred without AI investment

- Control group comparisons where possible for rigorous measurement

- Statistical significance testing for claimed improvements

- Attribution modeling for shared benefits across multiple initiatives

Measurement and Tracking Systems

Ongoing measurement validates projections and enables continuous optimization to maximize returns.

Key Performance Indicators

- Leading indicators showing adoption and usage patterns

- Process metrics tracking efficiency improvements in real-time

- Quality metrics monitoring accuracy and error rates

- Financial metrics aggregating cost savings and revenue impacts

- Strategic indicators measuring competitive positioning and market response

Reporting Cadence and Governance

- Weekly operational dashboards for implementation teams

- Monthly business reviews tracking benefits against projections

- Quarterly executive updates on ROI achievement and strategic impact

- Annual comprehensive assessments informing future AI investments

- Ad-hoc deep dives investigating anomalies or opportunities

Continuous Improvement Process

- A/B testing for AI model variations and configuration options

- User feedback collection identifying enhancement opportunities

- Performance regression detection and root cause analysis

- Benefit leakage prevention through ongoing change management

- Scale-up planning to extend successful implementations to additional use cases

8. Common Pitfalls to Avoid When Calculating AI ROI

Understanding mistakes other organizations have made helps you calculate true enterprise AI ROI more accurately and avoid disappointment.

Underestimating Total Costs

Many AI initiatives exceed budgets because organizations fail to account for the full cost picture.

Hidden Implementation Expenses

- Data quality remediation requiring more effort than anticipated

- Legacy system constraints necessitating additional integration work

- Security and compliance requirements adding unexpected costs

- User acceptance testing revealing need for significant refinements

- Parallel processing during transition periods maintaining old and new systems

Ongoing Cost Escalation

- Model performance degradation requiring more frequent retraining than planned

- Feature requests and enhancements expanding scope beyond original vision

- Infrastructure scaling costs as usage exceeds projections

- Talent retention challenges requiring higher compensation to prevent turnover

- Vendor price increases upon contract renewal after initial promotional period

Overestimating Near-Term Benefits

Enthusiasm for AI capabilities sometimes leads to unrealistic benefit projections that damage credibility.

Adoption Curve Realities

- Employee resistance slowing actual usage despite system availability

- Learning curves reducing productivity initially before improvements materialize

- Change management challenges requiring longer transition periods

- Technical issues in production differing from proof-of-concept performance

- Process redesign needs becoming apparent only after deployment

Market Response Uncertainties

- Customer adoption of AI-powered features varying from expectations

- Competitive responses negating anticipated advantages

- Regulatory developments constraining certain AI applications

- Economic conditions affecting demand regardless of AI capabilities

- Integration challenges with customer systems limiting value realization

Ignoring Opportunity Costs

Resources allocated to AI initiatives have alternative uses that factor into true ROI calculations.

Alternative Investment Returns

- Other technology investments that could deliver comparable or superior returns

- Core business improvements that might generate more certain benefits

- Market expansion opportunities requiring similar capital allocation

- Debt reduction or shareholder returns as alternative uses of capital

- Risk mitigation investments competing for limited resources

Organizational Bandwidth

- Leadership attention diverted from other strategic priorities

- Technical resources unavailable for other initiatives during AI implementation

- Change capacity consumed limiting ability to pursue other transformations

- Opportunity cost of delayed initiatives awaiting AI completion

- Talent development trade-offs between AI skills and other capabilities

Conclusion: Making AI ROI Measurement Work for Your Organization

Learning to calculate true enterprise AI ROI represents more than an accounting exercise. It’s a strategic capability that enables better decision-making, more effective resource allocation, and clearer communication with stakeholders about AI’s value and potential.

The most successful organizations approach AI ROI measurement as an ongoing practice rather than a one-time calculation. They establish baseline metrics before implementation, track progress continuously, and adjust their approaches based on real-world results. This discipline ensures AI investments deliver promised returns while building organizational capability for future technology adoption.

Start your ROI calculation journey by thoroughly documenting current state performance, engaging stakeholders across functions in benefit identification, and establishing realistic timelines for value realization. Use the case studies and benchmarks in this guide as reference points while adapting frameworks to your specific context and industry dynamics.

Remember that learning how to calculate true enterprise AI ROI involves both art and science. Quantitative metrics provide essential rigor, but qualitative factors like competitive positioning, employee experience, and strategic optionality often determine long-term success. Balance precision in measurement with acknowledgment of uncertainty, and communicate both the opportunities and risks inherent in transformative technology investments.

Organizations that master AI ROI calculation position themselves to make better investment decisions, optimize implementations more effectively, and build confidence among stakeholders that AI initiatives create genuine value. This capability becomes increasingly critical as AI evolves from experimental technology to core business infrastructure requiring sustained investment and continuous refinement.

Also read this:

GPT-4o vs Claude vs Gemini: The Ultimate AI Model Showdown (Accuracy, Speed & Real-World Tests)

How to Create AI Workflows That Reduce Manual Work by 70% (Proven Methods)

Best AI Assistants for Daily Productivity That Boost Efficiency Instantly