Online fraud has reached unprecedented levels, costing businesses and consumers billions of dollars annually. From sophisticated phishing schemes to identity theft and payment fraud, cybercriminals are constantly evolving their tactics. Traditional security measures struggle to keep pace with these advanced threats, which is where AI Fraud Detection Tools become indispensable for modern businesses.

In this comprehensive guide, we’ll explore the leading AI Fraud Detection Tools transforming online security, their capabilities, implementation strategies, and how to choose the right solution for your organization. Whether you operate an e-commerce store, financial institution, or any digital business, understanding these advanced security tools is crucial for protecting your assets and customers.

The Rising Threat of Online Fraud

The digital economy’s explosive growth has created unprecedented opportunities for fraudsters. According to recent industry reports, online fraud attempts have increased by over 150% in the past three years alone. The costs extend beyond direct financial losses—damaged reputation, lost customer trust, and regulatory penalties can cripple businesses.

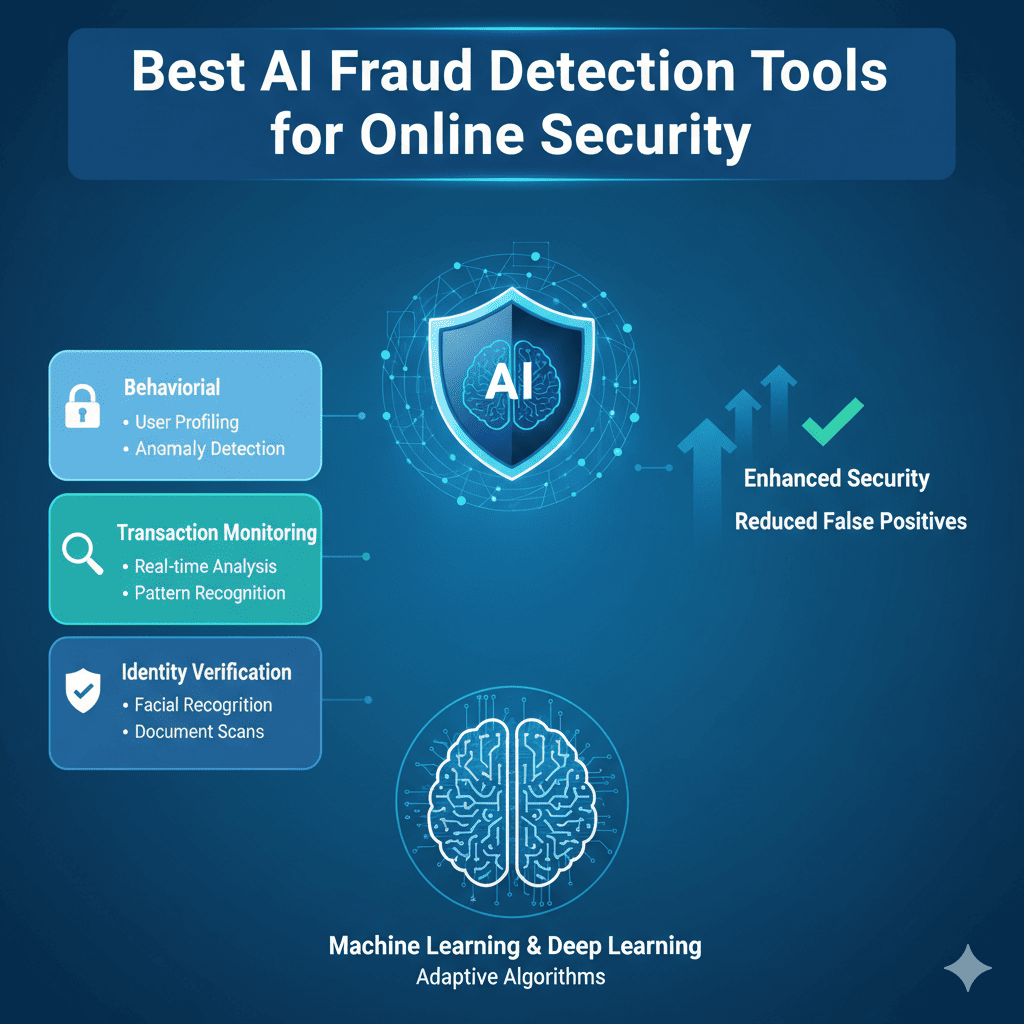

Traditional rule-based fraud detection systems operate with fixed parameters that fraudsters quickly learn to circumvent. They generate excessive false positives that frustrate legitimate customers and waste security team resources. AI Fraud Detection Tools represent a paradigm shift, using machine learning to adapt in real-time, recognize sophisticated patterns, and distinguish genuine transactions from fraudulent ones with remarkable accuracy.

Modern AI systems analyze hundreds of variables simultaneously—user behavior patterns, device fingerprints, transaction history, geolocation data, and countless other signals—to assess fraud risk in milliseconds. This comprehensive analysis happens invisibly in the background, providing robust protection without disrupting the user experience for legitimate customers.

1. Understanding How AI Fraud Detection Tools Work

AI Fraud Detection Tools leverage multiple advanced technologies working in concert to identify and prevent fraudulent activities before they cause damage.

Machine Learning Algorithms

At the core of these systems are sophisticated machine learning models trained on vast datasets containing millions of transactions, both legitimate and fraudulent. These algorithms identify subtle patterns and correlations that would be impossible for humans to detect manually.

Supervised learning models train on labeled historical data, learning to distinguish characteristics of fraudulent versus legitimate behavior. Unsupervised learning identifies anomalies and outliers that don’t conform to established patterns, catching novel fraud schemes that haven’t been seen before. Deep learning neural networks process multiple layers of data simultaneously, capturing complex relationships between variables.

As these systems process more data, they continuously improve their accuracy through feedback loops. When fraud analysts confirm or reject AI predictions, the system learns from these decisions and refines its future assessments.

Behavioral Analytics

Modern AI Fraud Detection Tools build detailed behavioral profiles for each user based on their typical patterns. These profiles encompass typing speed and rhythm, mouse movement patterns, navigation habits, preferred devices and browsers, typical transaction amounts, common purchase categories, and usual transaction times.

When a user’s behavior deviates significantly from their established profile—perhaps logging in from an unusual location, accessing the account at an atypical time, or making purchases that don’t match their history—the system raises alerts or implements additional verification steps. This behavioral approach catches account takeovers even when fraudsters have obtained legitimate credentials.

Real-Time Risk Scoring

Every transaction or interaction receives an instant risk score based on hundreds of factors analyzed simultaneously. High-risk scores trigger immediate intervention, which might include additional authentication requirements, transaction holds for manual review, automatic blocking in extreme cases, or notifications to security teams and customers.

This real-time capability is crucial for preventing fraud before it succeeds. By the time traditional systems detect problems, the damage has already occurred. AI systems stop threats at the point of attempted fraud, minimizing losses and protecting customers.

Network Analysis

Advanced AI Fraud Detection Tools don’t analyze transactions in isolation—they examine relationships and connections across the entire network. Graph analytics identify suspicious patterns like multiple accounts sharing devices or IP addresses, coordinated attacks from seemingly unrelated accounts, velocity attacks with rapid-fire transactions, or patterns suggesting organized fraud rings.

This network perspective reveals sophisticated fraud operations that might appear legitimate when examining individual transactions but expose themselves through their connections and coordination patterns.

2. Leading AI Fraud Detection Tools for E-commerce

Online retailers face unique fraud challenges, from stolen credit cards and account takeovers to return fraud and fake reviews. These specialized tools address e-commerce security needs.

Signifyd

Signifyd has established itself as a leader in e-commerce fraud protection by combining advanced AI with a unique financial guarantee. The platform analyzes over 1 billion transactions annually, using this vast dataset to continuously refine its fraud detection models.

What sets Signifyd apart is its Commerce Protection Platform that guarantees approved orders against fraud chargebacks. This shifts the risk from merchants to Signifyd, allowing businesses to approve more orders confidently without fear of fraud losses. The AI evaluates transactions in milliseconds, considering payment information, customer behavior, device fingerprinting, order details, and historical patterns.

For growing e-commerce businesses, Signifyd’s automated decision-making eliminates manual review bottlenecks while maintaining approval rates above 98%. The system adapts to each merchant’s specific customer base and fraud patterns, providing customized protection that improves over time.

Riskified

Riskified specializes in helping e-commerce merchants maximize revenue while minimizing fraud risk. Their AI platform has reviewed billions of transactions globally, developing deep expertise across industries and geographies.

The platform’s chargeback guarantee means Riskified assumes liability for approved fraudulent transactions, providing merchants complete peace of mind. This confidence allows businesses to approve more borderline transactions that traditional systems would reject, capturing revenue that would otherwise be lost to false positives.

Riskified’s machine learning models consider global fraud patterns alongside merchant-specific data, providing both broad perspective and tailored protection. The system excels at identifying policy abuse, including account takeovers, promotion abuse, and return fraud—challenges that extend beyond payment fraud.

Sift

Sift offers comprehensive fraud protection spanning the entire customer lifecycle, from account creation through transactions to content moderation. Their Digital Trust & Safety platform uses machine learning to stop fraud, abuse, and policy violations across digital businesses.

The platform’s global data network analyzes signals from thousands of websites and apps, identifying fraud patterns that cross business boundaries. When fraudsters target one Sift customer, the network learns and protects all customers from similar attacks.

Sift’s flexibility allows businesses to customize fraud strategies based on risk tolerance and business objectives. Pre-built workflows handle common scenarios while custom rules address unique requirements. The system’s device fingerprinting technology tracks devices across sessions and accounts, identifying fraudsters even when they create new accounts.

3. Banking and Financial Services AI Fraud Detection Solutions

Financial institutions face the most sophisticated fraud attacks and strictest regulatory requirements. These enterprise-grade solutions meet banking industry demands.

FICO Falcon Fraud Manager

FICO pioneered the use of AI in fraud detection decades ago, and their Falcon platform remains the gold standard for financial institutions. The system protects billions of payment cards worldwide, preventing fraud losses while maintaining seamless experiences for cardholders.

Falcon’s adaptive analytics continuously learn from new fraud patterns, updating risk models automatically without manual intervention. The platform analyzes transactions across multiple channels—cards, online banking, mobile apps, and wire transfers—providing comprehensive protection across the entire financial institution.

Advanced capabilities include consortium-level intelligence sharing across financial institutions, peer group analysis comparing account behavior to similar account segments, anomaly detection identifying unusual patterns that might indicate emerging fraud, and real-time decisioning that approves or declines transactions in milliseconds.

FICO’s neural network models process complex relationships between variables that linear models miss, catching sophisticated fraud schemes that evade traditional detection systems.

Feedzai

Feedzai specializes in fighting financial crime with AI-powered solutions for banks, payment processors, and retailers. Their RiskOps platform combines machine learning, data science, and operational tools into a comprehensive fraud management system.

The platform excels at detecting various financial crimes including payment fraud, account takeover, application fraud, money laundering, and internal fraud. Feedzai’s AI models analyze transactions across channels, building comprehensive risk profiles that consider the full context of each transaction.

Real-time model monitoring ensures continued accuracy as fraud patterns evolve. Automated retraining keeps models current without requiring data scientist intervention. The platform’s explainable AI provides clear reasoning for decisions, crucial for regulatory compliance and fraud analyst trust.

DataVisor

DataVisor pioneered unsupervised machine learning for fraud detection, enabling the identification of previously unknown fraud patterns without training on historical fraud data. This approach catches emerging fraud schemes on day one, before they’ve caused significant damage.

The platform’s dCube intelligence platform correlates billions of events in real-time, identifying coordinated attacks and fraud rings. Feature platform automatically generates sophisticated analytical features from raw data, reducing the data science resources required for effective fraud detection.

DataVisor’s solutions span the financial services ecosystem, protecting digital banking, payment processing, lending operations, and cryptocurrency exchanges. Their global intelligence network shares threat intelligence across customers while maintaining data privacy and competitive confidentiality.

4. Identity Verification and Authentication AI Tools

AI Fraud Detection Tools focused on identity verification prevent fraud at the entry point, ensuring only legitimate users access systems and services.

Jumio

Jumio provides AI-powered identity verification and authentication solutions that validate user identities during account opening and throughout the customer lifecycle. Their platform combines document verification, biometric authentication, and liveness detection to ensure the person presenting credentials is who they claim to be.

The AI analyzes government-issued IDs from over 200 countries, detecting forgeries and alterations that humans would miss. Advanced computer vision validates security features like holograms, microprinting, and special inks. Biometric face matching compares selfies to ID photos, ensuring the document belongs to the person presenting it.

Liveness detection prevents fraudsters from using photos or videos to impersonate legitimate users. The system requires users to perform specific actions proving they’re physically present rather than presenting recorded media.

Onfido

Onfido’s AI verifies user identities by analyzing government-issued IDs and matching them to biometric data. The platform serves businesses across industries, from financial services and sharing economy platforms to online gaming and healthcare.

Machine learning models trained on millions of identity documents recognize legitimate IDs while flagging counterfeits, alterations, and fraudulent documents. The system adapts to new fraud techniques as they emerge, maintaining high accuracy against evolving threats.

Onfido’s Studio platform allows businesses to customize verification workflows based on risk levels and regulatory requirements. Low-risk users might complete streamlined verification while high-risk scenarios trigger enhanced checks. This flexibility optimizes the balance between security and user experience.

IDology

IDology, now part of GBG, specializes in identity verification for the U.S. market, leveraging vast databases of consumer information to validate identities without requiring document uploads. This knowledge-based authentication approach verifies identities through questions only the legitimate individual could answer.

The platform’s ExpectID solution combines identity verification, fraud detection, and age verification into an integrated workflow. Machine learning analyzes identity data, device intelligence, and behavioral signals to assess fraud risk comprehensively.

For businesses operating primarily in the United States, IDology’s deep integration with U.S. credit bureaus and data sources provides verification capabilities that international platforms can’t match.

5. AI Tools for Payment Fraud Prevention

Protecting payment processing is critical for any business accepting online transactions. These specialized AI Fraud Detection Tools focus specifically on payment security.

Stripe Radar

Stripe Radar protects businesses using Stripe’s payment processing platform, leveraging data from millions of companies globally to identify fraud patterns. The system evaluates every transaction using machine learning models trained on Stripe’s vast network data.

Radar’s adaptive fraud engine creates custom risk models for each business based on their specific fraud patterns and customer base. The system improves accuracy over time as it processes more of your transactions, learning what normal looks like for your business.

Advanced capabilities include machine learning that adapts to your business automatically, 3D Secure authentication integration for European regulatory compliance, customizable rules for addressing unique fraud scenarios, and real-time risk scores for every transaction. The platform’s automation handles fraud detection without requiring dedicated fraud analysts, making enterprise-grade protection accessible to businesses of all sizes.

Adyen Risk Management

Adyen provides a unified commerce platform that includes advanced fraud detection as a core component. Their risk management system processes payments across channels—online, mobile, and point-of-sale—providing consistent protection everywhere transactions occur.

The platform’s machine learning models analyze transaction data alongside contextual information like device fingerprints, behavioral patterns, and cardholder authentication results. Risk scores guide automatic approve/decline decisions or flag transactions for manual review based on configurable thresholds.

Adyen’s global acquiring infrastructure means they manage fraud liability for merchants, providing strong incentive to maintain highly accurate fraud detection. This alignment of interests ensures continuous investment in improving fraud prevention capabilities.

Kount

Kount’s AI-driven fraud prevention platform protects digital businesses across industries with solutions for payment fraud, account security, and content moderation. Their Identity Trust Global Network analyzes billions of annual transactions, providing broad fraud intelligence alongside business-specific learning.

The platform’s Persona technology builds detailed trust profiles for each customer based on their interactions across devices, channels, and sessions. These persistent identities allow accurate fraud assessment even when customers use different devices or browsers.

Kount offers flexible deployment options from fully automated decisioning to custom rules and manual review queues. This adaptability serves businesses at various stages of fraud maturity, from startups implementing fraud prevention for the first time to enterprises with dedicated fraud teams.

6. Benefits of Implementing AI Fraud Detection Tools

Deploying AI Fraud Detection Tools delivers measurable improvements across multiple business dimensions beyond simply reducing fraud losses.

Significant Cost Reduction

Direct fraud losses represent only part of the total cost of fraud. Chargebacks carry additional fees, often $20-50 per incident. Disputes consume customer service resources. False positives reject legitimate customers who might never return. When considering all these factors, the total cost of fraud can be three to five times the direct fraud losses.

AI Fraud Detection Tools reduce costs across all these dimensions. More accurate fraud detection means fewer fraud losses, fewer chargebacks, less time spent investigating false positives, and fewer legitimate customers incorrectly declined. The cumulative savings typically far exceed the cost of the fraud detection platform itself.

Improved Customer Experience

Traditional fraud prevention often creates friction for legitimate customers—declined transactions, security questions, lengthy verification processes. This friction causes cart abandonment, damages customer relationships, and costs businesses revenue.

AI systems protect security without unnecessary friction. By accurately distinguishing fraudulent from legitimate behavior, they allow trusted customers to transact smoothly while applying enhanced scrutiny only where genuinely warranted. This risk-based approach maximizes both security and user experience.

Behavioral analytics enable systems to recognize legitimate customers even from new devices or locations, reducing false security alerts. Seamless security becomes invisible to customers while remaining impenetrable to fraudsters.

Faster Transaction Processing

Manual fraud review creates bottlenecks that delay order fulfillment and frustrate customers expecting instant gratification. AI Fraud Detection Tools evaluate transactions in milliseconds, providing immediate approve/decline decisions without human intervention.

This speed is crucial for digital businesses where customer expectations center on instant service. Whether completing a purchase, opening an account, or processing a refund, automated fraud detection maintains the rapid pace customers demand while ensuring security.

Scalability and Adaptability

As businesses grow, transaction volumes increase exponentially. Manual fraud review doesn’t scale—doubling transaction volume means doubling fraud analyst headcount. AI scales effortlessly, processing millions of transactions with the same efficiency as hundreds.

The adaptability of machine learning ensures protection keeps pace with evolving fraud tactics. As fraudsters develop new schemes, AI Fraud Detection Tools learn from these attempts and update their models, maintaining effectiveness against emerging threats without requiring manual rule updates.

Regulatory Compliance

Financial services businesses face strict regulatory requirements around fraud prevention, anti-money laundering, and customer protection. AI Fraud Detection Tools help meet these obligations through comprehensive monitoring, detailed audit trails, automated reporting capabilities, and explainable AI that documents decision reasoning.

The documentation and transparency these systems provide simplify regulatory audits and demonstrate due diligence in fraud prevention efforts.

7. How to Choose the Right AI Fraud Detection Tool

Selecting the optimal AI Fraud Detection Tools for your business requires careful evaluation of multiple factors aligned with your specific needs and circumstances.

Assess Your Fraud Risk Profile

Different businesses face different fraud threats. E-commerce sites primarily worry about payment fraud and account takeovers. Financial institutions face broader threats including application fraud, money laundering, and insider fraud. SaaS companies deal with subscription fraud and fake account creation.

Understanding your primary fraud vectors guides you toward tools specialized for your risk profile. A solution perfect for banking might be overkill for a small online retailer, while e-commerce-focused tools might lack capabilities financial institutions require.

Analyze your historical fraud data to understand which types of fraud cause the most losses, what percentage of transactions are fraudulent, how many false positives your current system generates, and where fraud detection gaps exist in your current processes.

Evaluate Integration Requirements

AI Fraud Detection Tools must integrate with your existing technology infrastructure. Consider compatibility with your payment gateway or processor, e-commerce platform or core banking system, customer database and CRM, authentication systems, and data warehouses for analytics.

Poor integration creates data silos and manual workflows that undermine efficiency. Prioritize solutions offering native integrations with your critical systems or open APIs that your development team can work with effectively.

Consider Implementation Complexity

Some fraud detection platforms require months of implementation, extensive data science resources, and significant customization. Others offer quick deployment with pre-built models that start working immediately.

For businesses without dedicated fraud teams or data science expertise, managed solutions that handle model development and maintenance provide better value. Enterprises with sophisticated requirements might prefer platforms offering granular control and customization capabilities.

Analyze Pricing Models

AI Fraud Detection Tools employ various pricing structures—per-transaction fees, monthly subscriptions based on volume, percentage of payment value, or hybrid models combining multiple elements. Calculate projected costs across different usage scenarios, not just current volumes.

Consider whether the vendor charges for declined transactions, only approved transactions, or all transactions evaluated. Understand minimum fees or commitments. Some vendors offer chargeback guarantees or fraud insurance that might justify higher per-transaction costs through risk transfer.

Review Accuracy and Performance Metrics

Request detailed performance data from potential vendors including false positive rates, fraud detection rates, average processing latency, and model update frequency. Independent validation from current customers provides more reliable insights than vendor-provided statistics.

Consider running a pilot or proof-of-concept with your actual transaction data. Many vendors offer trial periods or limited deployments that demonstrate real-world performance before full commitment.

Evaluate Vendor Support and Expertise

Fraud prevention is complex and constantly evolving. Strong vendor support becomes crucial when implementing new systems, responding to fraud attacks, or optimizing performance. Assess the availability of technical support, fraud analyst expertise, and implementation assistance.

Review the vendor’s track record—how long have they been in the fraud prevention space? Do they work with businesses similar to yours? Are they keeping pace with emerging fraud trends and technologies?

8. Implementation Best Practices for AI Fraud Detection Tools

Successfully deploying AI Fraud Detection Tools requires strategic planning and careful execution to maximize effectiveness while minimizing disruption.

Start with Clear Objectives

Define specific, measurable goals for your fraud prevention initiative. Examples might include reducing fraud losses by 50%, decreasing false positive rates to under 1%, automating 95% of fraud decisions, or improving customer satisfaction scores related to transaction approval.

Clear objectives guide implementation decisions and provide benchmarks for measuring success. Without defined goals, it’s difficult to assess whether the system is performing adequately or requires optimization.

Implement Gradually

Rather than immediately routing all transactions through new fraud detection systems, phase implementation gradually. Start with a shadow mode where the AI system evaluates transactions but doesn’t make final decisions, allowing you to validate performance against current systems.

Progress to handling low-risk transactions first, maintaining existing processes for high-value or complex scenarios until you’ve validated the AI system’s accuracy. Gradual rollout minimizes risk and provides opportunities to refine configurations before full deployment.

Maintain Human Oversight Initially

While AI Fraud Detection Tools automate fraud detection, maintain fraud analyst review of edge cases and high-risk transactions during initial implementation. This human oversight serves multiple purposes—validating AI decisions, catching errors before they impact customers, providing feedback that improves model accuracy, and maintaining institutional fraud expertise.

As confidence in the system grows, gradually expand the range of automated decisions while retaining human review for the most complex scenarios.

Monitor Performance Continuously

Track key performance indicators daily during initial implementation and weekly afterward. Important metrics include fraud detection rates, false positive rates, processing latency, transaction approval rates, and customer complaint rates related to declined transactions.

Establish alert thresholds that trigger investigation when metrics deviate from expected ranges. Prompt detection of performance issues prevents small problems from escalating into major incidents.

Optimize Based on Data

Use insights from your AI Fraud Detection Tools to continuously refine fraud prevention strategies. Analyze which fraud vectors cause the most losses, identify patterns in false positives to reduce customer friction, recognize times or channels with elevated fraud risk, and evaluate the effectiveness of specific detection rules or models.

This data-driven optimization ensures your fraud prevention capabilities continually improve rather than remaining static after initial implementation.

Maintain Fraud Awareness

While AI handles tactical fraud detection, maintain strategic awareness of fraud trends affecting your industry. Participate in information-sharing groups, monitor industry publications for emerging threats, and review fraud analytics regularly with leadership teams.

This broader perspective ensures your fraud prevention strategy evolves proactively rather than reactively responding only after attacks succeed.

Future Trends in AI Fraud Detection

The evolution of AI Fraud Detection Tools continues accelerating as new technologies emerge and fraud threats grow more sophisticated.

Federated Learning

Privacy regulations limit data sharing that powers fraud detection networks. Federated learning enables collaborative fraud detection where machine learning models learn from distributed datasets without centralizing sensitive information. Financial institutions can collectively combat fraud while maintaining customer data privacy and competitive confidentiality.

This technology allows smaller businesses to benefit from fraud intelligence typically available only to large enterprises with vast transaction volumes.

Explainable AI

As regulations increasingly require transparency in automated decision-making, explainable AI provides clear reasoning for fraud decisions. Rather than treating AI as a black box, these systems articulate which factors influenced specific decisions, enabling human oversight and regulatory compliance.

For businesses in regulated industries, explainable AI capabilities are becoming mandatory rather than optional features.

Quantum-Resistant Security

As quantum computing advances, current encryption methods face obsolescence. AI Fraud Detection Tools are incorporating quantum-resistant algorithms to ensure continued security as computing capabilities evolve. This forward-looking approach protects businesses from future cryptographic vulnerabilities.

Biometric Authentication Integration

Advanced biometric technologies including facial recognition, voice authentication, behavioral biometrics, and even heartbeat patterns provide stronger identity verification than traditional credentials. Integration of these modalities with AI fraud detection creates layered security that’s nearly impossible to defeat.

Continuous authentication validates user identity throughout sessions rather than just at login, catching account takeovers in real-time.

Conclusion

AI Fraud Detection Tools have become essential infrastructure for digital businesses, providing the sophisticated protection necessary to combat increasingly advanced fraud threats. The question for businesses is no longer whether to implement AI-powered fraud prevention, but which solution best aligns with their specific needs and risk profile.

The investment in robust AI Fraud Detection Tools pays dividends through reduced fraud losses, improved operational efficiency, enhanced customer experiences, and regulatory compliance. As fraud continues evolving, businesses relying on outdated detection methods face growing risks and costs.

Begin your evaluation by assessing your specific fraud challenges, testing leading platforms with your actual transaction data, and engaging with vendors who demonstrate deep expertise in your industry. The right AI Fraud Detection Tools will become a competitive advantage, enabling you to serve customers confidently while fraudsters target less-protected competitors.

Also read this:

Top AI Tools for Real Estate Lead Generations: Transform Your Business in 2025

Best AI Appointment Scheduling Tools for Businesses: Transform Your Booking Process in 2025